Good fleet safety management is about two things.

Reacting rapidly and effectively when things go wrong.

And spotting the elements and trends that are likely to cause things to go wrong in the first place.

Master the second, and you will minimise the need for the first.

Often, the key to that mastery is using the data you already have, more effectively.

Crack that, and you can spot those drivers, routes, and times of day when your risk is being pushed to the limit. Allowing you to focus your management, safety, and training resources at those critical points, to reduce risk.

The data is in telematics reports, dashcam videos, tachograph downloads, driver reviews, phone apps, incident reports, training records, corporate systems, compliance documents and operations software.

And where is all this data commonly brought together for analysis and insight? In Excel spreadsheets

On the surface, this makes sense, as Excel is used around the world, is a basic office skill, and therefore provides a simple to deploy solution that is familiar to its users.

However, just because it’s a ubiquitous skill doesn’t mean it is the right tool for fleet safety management.

A top reason why you shouldn’t use Excel for fleet safety management is that it isn’t as precise as you might think.

Excel is by its nature often difficult to reconcile and draw analysis from, when the data goes beyond just a few sources.

Matching cells have to be identical. Whole afternoons can be lost in trying to manipulate all the data into one sheet or getting it to connect to someone else’s spreadsheet. Then, when you’ve done that, someone changes their report structure, and it messes yours up.

Studies have shown that close to 90% of spreadsheets contain errors. These range from human errors to programming errors, to the capacity limitations of Excel.

Excel can also be very time consuming, as although it has automation tools, these are often of an advanced user level, which many (most?) users are not at. Meaning that they will rely on cut & paste operations or manual inputs, both of which are by their nature, prone to error.

Additionally, Excel is not user-friendly. It seems easy to use at the beginning, with simple actions and calculations. But when more complex operations are required, such as coding macros, it isn’t that easy, and bugs can arise that are difficult to identify and fix.

So, if you’re wanting to analyse and model your fleet safety management actions and strategy accurately, by relying on Excel, you are introducing a large element of inaccuracy in to your work.

You’re also using a time-consuming tool to update and maintain, and one that often relies on the team’s Excel expert to keep it running.

All of which can be very costly for your fleet safety management over the medium to long term.

Unless you have the discipline to keep a separate file or tab snapshot of each previous reporting period, you are at risk of losing your historical data and the related audit trails of the data.

Which means you lose the ability to dive into the detail or re-analyse historical performance.

Of course, if you do have that discipline, you’ll end up with an unsustainably large Excel spreadsheet, which as mentioned above is prone to error, and with no track changes capability, if data is accidentally deleted or changed, you have no idea that it’s happened.

The alternative option, that of multiple spreadsheets, is also a real challenge.

For example, if you’re working on numerous spreadsheets, say one for each team or branch, you can be in a situation where you have to modify multiple spreadsheets, email them out to appropriate colleagues, and make changes, as necessary. Keeping up with all the actions in this scenario can become a nightmare and one that increases the likelihood of human error in fleet safety management and data analysis.

Which is our next key issue with using Excel for fleet safety management.

Everyone knows how to use Excel. That is both its appeal and its weakness for fleet safety management.

As it is so easy to use, it is very easy for someone to accidentally corrupt a data set, change a file’s structure, or simply change a cell’s format, and for those actions to have an impact on your reports and insight.

And if (when) that happens, one of the main issues with Excel is how you can find those errors?

Excel spreadsheets have no error control. They are therefore error-prone.

It’s easy to inadvertently change a cell or make mistakes. For example, users may realise that a macro was wrong by one cell after using the process for a long time. To correct this, they have to go back and figure out what and when the error happened.

This is not easy in Excel as there is no debugging tool or testing capability to inspect whether all cells keep working as expected, for example after a change.

All of which gives rise to a situation that we’ve all experienced: a well-intentioned colleague updating our Excel spreadsheet, making an innocent error, which makes our reporting inaccurate, and then us losing an afternoon figuring out what went wrong.

Ultimately, Excel is a great tool for simple, ad hoc calculations. But its lack of formal structure, complexity in automation and lack of error control make it error-prone.

This in turn compromises its capability to support an effective and robust fleet safety management strategy and program.

For effective, data-driven fleet safety management strategies and programs, fleet managers really need to move away from using Excel.

They need to make the shift to using a more effective and resourceful platform.

A platform that takes away the tasks of collecting, analysing, and interpreting data.

A platform that has automatic data standardisation, quality monitoring and data audit logs.

A platform that significantly reduces the chances of human error.

A platform that gives fleet managers the ability to review risk at any time in the past, via data visualisation features that they can tailor to their fleet safety management needs.

A platform that leaves the fleet manager focussed on what the data is telling them about fleet safety management, rather than spending time importing, exporting, and arranging data.

May we suggest, a platform like Clara.

First notification of Loss, better known as FNOL in the insurance, fleet, and transport management industries, is the first report to an insurer about the damage, loss, or theft of an insured vehicle.

As such it is the very first step in an insurance claim process.

Additionally, FNOL is a widely used term in telematics and telematics data management. Here, it describes the automated alert that is triggered by readings (about a vehicles g-forces) within a telematics device. Be that an older black box, or a newer camera.

These alerts help fleet and transport managers by letting them know an incident has happened. They can then rapidly react to manage the situation. Checking on the safety of the driver and any third parties, notifying insurers or emergency services, updating customers who may be impacted by the involved vehicle’s situation, etc.

Well, that’s the theory

Unfortunately, telematics devices are very sensitive, reacting to all sorts of nudges, bumps, and bangs on a vehicle. This triggers a lot of false positives to the transport managers. Who eventually stop reacting to every alert, as they could be caused by a door being slammed, driving over a pothole, or hard braking from taking an unfamiliar corner too fast.

This, of course, can create a situation where a true incident, that requires a FNOL, can go unnoticed. The reaction only comes when the vehicle driver notifies the transport manager, which could be at the end of a shift or even later.

Which is not an ideal situation.

Basically, cost control.

Of course, the safety of all involved comes above this, and in cases where major injury or loss of life is likely, the need for rapid FNOL is paramount.

However, in non-life-threatening or non-major injury incidents, the faster a transport manager or insurer can react to an incident the better they can take charge and manage the associated cost elements. Allowing them a better chance of keeping the costs under control.

As a direct illustration of this, in the late 2000s a leading car rental company ran a campaign to get its renters to call a dedicated helpline should they have an incident.

By doing this, the company could take control of the incident, managing it with its own resources, while also providing better peace of mind and service to its customers and any involved third parties.

This campaign was based on the company’s analysis that showed the cost of an average incident – repairs, provision of replacement vehicles, insurance elements, etc – if internally managed could be kept to £300.

If third parties became involved – other insurance companies, accident management organisations, replacement vehicles hired from other (often competing) car rental companies, etc – the average cost would increase to £3000.

Tenfold increases like this, as well as vehicle downtime impacts customer service, and has a medium-term effect on insurance rates.

This is why fast, accurate FNOL is so important to fleet operators, transport companies and insurers.

For more on this, this article in Fleet News, from a few years ago, is worth reading.

So, the need for fast and accurate FNOL is important in preventing loss of life, and cost control. However, the tools for fast and accurate FNOL, telematics, are flawed in providing accurate FNOL.

What can be done?

Well, that’s where CMS comes into play.

We specialise in telematics data aggregation, which is built on our fundamental research into the needs of the transport and insurance industries.

These needs are served by our market-leading technology.

With this, we have solved the conundrum of the need for fast and accurate FNOL without the forest of false positives from the telematics devices used by fleet operators and insurers.

Our SaaS platform, Clara, is hardware agnostic, taking in data from any telematics, employee or other connected data sources. It then makes the data consistent and comparable, over time and across original sources, via our AI and machine learning-based technologies.

This delivers the time-critical FNOL alerts that are needed by transport managers, fleet operators and insurers. Plus, provides a simple, single point of view of an organisation’s risk profile.

With this, organisations can reduce claim frequencies, reduce claim costs, improve the effectiveness of training programs, and significantly reduce, or eliminate manual data management.

All of which adds up to making a safer world.

If you would like to find out more about how CMS can help your organisation get fast, accurate FNOL alerts, and better insight to support your fleet risk management programs, please contact us here.

As we continue our business growth and team expansion plans, CMS is very pleased to introduce another new recruit, Calvin Barradas, joining us as Software Engineer.

Joining the team at the tail end of last year, Calvin is mainly working on the API’s for our risk management SaaS platform, which is at the heart of our expertise in telematics data aggregation.

With this, he is helping to expand and evolve the capabilities of this hardware-agnostic solution. Enabling it to bring in even more data sources for risk profiling, and the answering of the four key risk management questions.

As things develop, he’ll also contribute to the development of the platform’s UI.

Calvin has followed an interesting path to CMS, and our head office location in Milton Keynes (albeit, not quite, due to our ongoing office use precautions for Covid, and work from home policy).

His family is from the small Portuguese island of Madeira, which is about 300 miles west of Morocco. However, he has joined us from Pretoria in South Africa, where he worked for IoT.nxt, a software development company offering IoT solutions.

As Calvin says, his three years at IoT.nxt was a great learning curve as the company went from a small team of twenty in Pretoria, to 200 plus, with offices in the Netherlands and the USA.

Calvin worked on the core product development, which was then tailored for customers, by industry – such as mining, telecoms, and manufacturing.

Outside of work, and in normal times, Calvin relaxes and keeps fit by playing five-a-side football.

While the summer will hopefully see a return to being able to play football, he currently gets his footie fix by watching, cheering, and cursing his team, Manchester United.

This means, given we have Chelsea and Liverpool fans in team CMS, there will be plenty of rivalry and Monday morning quarterbacking when we all eventually get back to the office.

Calvin’s other passion, and no prizes for guessing this one, is gaming. His current obsession (his words) is Valorant, a team-based FPS.

Again, given the prevalence of gamers in the company, there should be plenty to catch up on in normal times.

Other than that, Calvin admits that he isn’t a great lover of films. Although, he recently watched the Harry Potter series. This was at the insistence of his girlfriend, and he grudgingly concedes that he did enjoy them.

Maybe having seen the films, Calvin will pick up the HP books? As he also reveals he’s not a great reader, although he does list Spud as his favourite book. That’s a South African authored novel about life at boarding school.

So, take Spud, throw in a few wizards and some mysteries, and maybe the Harry Potter books will get a visit?

When asked what his favourite place is, Calvin replies Madeira.

Obviously, a beautiful place in its own right, but given that most of his family live on the Island, the connection and affection are understandably doubled.

Also, it may prove a handy hideaway, as Calvin boasts to having once, albeit awkwardly, stared down the Springbok’s Team Captain, John Smit.

Which is either a brave or a foolish thing to have done, but nevertheless, an achievement.

One final thing that Calvin would like to share is his thanks to team CMS for the support, help and welcome he got with his move to the UK from South Africa.

That has made the move enjoyable, despite the challenge of leaving South Africa at the height of summer to relocate to the UK in the depths of winter.

From CMS’ side, as we have said with all our recent recruits, Calvin is a very welcome and warmly welcomed addition to Team CMS.

Sitting in a niche covering fleet management, technology, risk management, workplace safety and insurance, CMS has some distinct perspectives on the trends coming to the fore this year and beyond.

In this post we look at 5G and how it will enable the Internet of Things

Late 2019 – early 2020 saw the beginning of the roll out of the new 5G network, and later in 2020, the launching of 5G capable phones from Samsung and Apple.

The vast majority, if not the complete, population, or country coverage for 5G is expected by the middle of the decade – say 2025 or 2026.

5G promises higher speeds and better connection to the internet, and by a significant factor over the existing 4G network.

But by how much?

Well, currently 4G gives the average mobile phone user a connection speed of between 20 and 30 Mbps (although it can be higher). This allows us to stream music on the go, surf the web, and navigate by Google maps when walking or driving.

5G promises a connection speed of over 10 Gbps. Or, between 100 and 1000 times faster than 4G.

As a simple illustration that means an 8GB HD film could be downloaded in less than ten seconds. While, on 4G it would take about ten minutes.

But 5G also comes with a huge increase in the capacity and capability for data transmission.

With figures of 10 Tbps (that’s equal to about 7 million images being upload to Instagram, per second!) and one million connections, per square kilometre, being quoted.

In simple practical terms, 5G means that buffering you get on your phone when you’re in a crowded bar, on a busy beach, or a packed shopping mall (OK – all pre-pandemic situations), will become a thing of the past.

The other promise of 5G is the effective elimination of connection latency. That is the time between doing something on your phone and the connection being made to allow it to happen.

The latency reduction is predicted to fall from the 50 milliseconds average of 4G to just one millisecond

Given the average human reaction speed is 250 milliseconds (about a quarter of a second), this reduction in latency means that there will be no discernable difference between the speed you react in a face to face situation and one that is communicated over the 5G network.

In simple terms 5G is better than 4G, as it is faster, and able to handle more connections. So, the way you use your phone now, will be better with 5G.

But that’s not what 5G really means.

The combination of increased speed, a bigger data pipe, removal of latency and a huge upscale in the number of connected devices, creates an environment that changes everything.

5G makes the concept of a fully connected world, via the Internet of Things (the IoT), not just a possibility, but a reality.

It will also not just improve what we currently do, it will enable the unknown.

A few examples to illustrate.

While 5G is a cellular based network, its capabilities will see it move beyond just cellphones.

There will be a merging of wifi and cellular connectivity, with 5G often displacing wifi, as it will be faster, more capable, and more stable.

Traditional wired and routed internet services will become redundant in a lot of business and consumer situations, when laptops, PC’s and other office devices move to a 5G connection.

Additionally, a whole host of devices can now be connected to the internet. In the house the heating system, and the security cameras, currently connected to your phone via wifi and 4G will be joined by everything from the fridge to the toaster, to the water meter, etc.

We’ll go from 20 to 30 connected devices in the house to 200 to 300, and more.

While this will make our domestic and office tasks easier or simpler, the real gains in the expanded connectivity will come outside the home or office.

Close to CMS’ operating area, with our risk management platform, Clara, built on data aggregation, what 5G will enable in road transport is revolutionary.

With everything from the latest Tesla car to the rider on a push bike connected to the network via 5G, the era of safe road transport, better traffic management and autonomous vehicles gets a big step closer.

Line of sight no longer becomes a limiting factor in traffic management – be that via the driver’s eyes, radar on the vehicle, or CCTV on busy traffic junctions, as all the traffic, the surrounding infrastructure, and even the pedestrians, in an area will all be connected to, and communicating with, each other.

Telling one another where they are, where they are going, what speed, etc.

Add this information into a traffic management system using edge computing and AI capabilities, and the traffic management infrastructure – both physical such as traffic lights, and software based such as routing apps – will work the maths to keep traffic flowing, prevent accidents, and get people to their destinations on time.

Ultimately, if this can all be done safely, with no delay in reaction, no limit to the number of connections, and a guarantee of reliability and stability, why will we need to drive ourselves?

The industrial Internet of Things, the digital industrial revolution, or Industry 4.0 has been happening for the last decade.

Manufacturing and distribution centres have been realising the value of monitoring and measuring everything from conveyor belt speeds, to supply levels, to the location of items in the yard, through digital technology. Bringing to life the old management adage “If you can measure, then you can manage”

5G will accelerate this process, as smaller, easier to install, sensors, with less power demands (10 year life batteries are not uncommon), are deployed and can all be connected to the management systems via the 5G network.

Data points will move from the tens, to the hundreds, and to the thousands, as everything in the manufacturing and distribution process can now be tracked, measured and thereby managed.

While this will help manage current models of manufacturing and distribution better, over time it will open up innovation and new thinking, which will in turn lead to new models and ways of doing things.

One of the oft talked about applications that 5G could make possible is straight out of science fiction. That of remote robotic surgery.

The idea that because of the elimination of the latency issue, a surgeon in London could operate on a patient in Glasgow, via 5G and the newest version of a DaVinci Robot, without any concerns about the network delaying the surgeons actions and reactions.

The positive or aspirational benefit of such a capability is that surgery and medicine could be deployed to remote areas of the world, which previously couldn’t access such support.

However, on a different side, roll out that capability over a global scale, and you could have a fundamental shift in the economics of medicine/healthcare.

For example, less expensive surgeons in India, could operate on patients in the USA. Either making medical costs cheaper in the USA, or giving bigger profits to the medical corporations.

That is 5G could shift world trade for highly skilled and professional roles, that currently need local fulfillment, in the same way as manufacturing shifted to lower cost bases in Eastern Europe in the 1990’s.

If so, the science fiction nature and marvel of what is happening would swiftly become secondary to the ramifications of what is being enabled economically, politically, and morally.

While all this promises to change the world by making the IoT real, we have been here before with technology.

It takes time for what the technology enables to be fully realised and matured.

Just ask those who took hits when the dot.com bubble burst.

So, the new reality that 5G enables, won’t happen overnight. It will be journey of change over five plus years, as the network rolls out and developers and innovators start to realise what can be done.

There will no doubt be dead ends, back tracks, and new approaches taken, before we can step back and say “Wow, the world has changed”

That is, it’s not 5G that will change the world, but all the things it enables, both as hardware & software, and also as human innovation and thinking – be that governments, corporations or start up innovators – that will change the world.

For CMS, 5G with its increase in data feeds, and data deployment, offers a step change in what we do – data aggregation.

Our CEO, Charles Smith, has been involved in some of the thinking around smart cities. Using CMS’ insight and expertise in data to help build out the knowledge and understanding of those charged with blueprinting the path to smart cities.

With our current focus on telematics and other driver data, we can see how 5G will both expand those data sets and make the data richer.

However, as we concluded on the EV and home delivery Trends 2021 articles, we can also see that innovation and disruption will significantly change what we think the future will be, in five or ten years time, and what it turns out to be.

And with 5G that mismatch between what can currently be predicted and what will transpire, with its enablement to step beyond improvement of what we do now, to enabling the building of the unknown, is even more pronounced than in the other trends we are looking at.

Sitting in a niche covering fleet management, technology, risk management, workplace safety and insurance, CMS has some distinct perspectives on the trends coming to the fore this year and beyond.

Over the next few posts we’ll explore those trends and share our views on what they mean.

In this post we look at Electric Vehicles.

The move to Electric Vehicles, or EV’s is happening at a faster pace than ever before.

In the UK where 59% of the vehicles on the road are company vehicles, the tipping point from majority of vehicles (under five years old) being internal combustion engine (ICE) to EV will happen when the company fleets shift.

That point is itself being driven by government policy, with the banning of new ICE vehicle sales by 2030 , as part of the government’s Green Industrial Revolution.

2030, for fleet management, is only 2-3 renewal cycles away.

Given that deadline, and the renewal cycle, we could potentially see a UK vehicle park of a majority of vehicles, that are three years or younger, being EV as early as 2027, or in just six years time.

Of course, there are some constraints and requirements that need to be sorted to help make the switch to EV – choice of vehicles, mileage or range, price and the supporting infrastructure.

This has largely been addressed, with all major manufacturers having EV offerings in both car and LCV’s, either available now or coming soon.

Even Toyota, which seemed to be clinging to hybrid technology and a rumoured view that hydrogen power might be the green solution, has launched an all electric car. Albeit via it’s Lexus brand, at this stage, with the new Lexus UX300e

When the Nissan Leaf launched, just over a decade ago, it had a range of 73 miles.

In its current iteration that has grown to 226 miles, or effectively three times what it was ten years ago.

As a marker of progress, this is a good one as it shows how battery technology is improving and how EV’s are getting to the magic range number of 300 miles on a charge, which is about equivalent to an ICE car’s distance on a tank of petrol.

However, range anxiety is still a major concern with EV’s.

That is based on if power runs out, in most cases a re-charge will take a significant amount of time (4+ hours).

So, a lot of work is going into the planning around and promotion of not the full charge distance, but the daily mileage needs.

The average working commute in the UK (pre-pandemic) is 20 miles, or 40 per day, which means that an EV car delivering 200+ miles is acceptable, as the user can reckon on doing an overnight charge every three or four days to stay mobile.

But what about LCV’s – how far does a home delivery van travel in a day, for example?

While data on this is scattered across news website articles and reddit posts, an average spread of 75-125 miles a day seems to be a reasonable assessment.

Which means that the 168 miles range of the UK’s best selling e-LCV, the Nissan e-NV200, is fit for purpose, with an overnight charge being needed between each working day.

Of course, there will be outliers in all these scenarios, but for a majority the current range capabilities of EV cars and LCVs are fit for the daily needs of their users.

Additionally, range anxiety will be addressed by the EV infrastructure build up and out (see below) plus technology developments (again, see below)

In a similar way to how the range discussion of EV’s is being reframed from a full charge range to the daily need, the value or cost of electric vehicles moves from the purchase price to the whole life cost.

Electric vehicles cost more to produce than ICE vehicles.

It comes down to the power pack – an internal combustion engine is cheaper to produce than an electric power pack.

This has led to incentives to encourage us to move to EV’s with discounts and subsidies to lower the sticker price.

But now, and in particular for fleets, the maths is changing.

While the purchase price is higher for EV’s, the running and maintenance costs are significantly lower.

So, at a cost per mile, whole life calculation, EV’s are competitive, if not better, than ICE vehicles.

The messaging, business advice, and accounting practices are all changing to this point of view on how to evaluate and decide on transitioning to EV’s, for businessess.

However, such change in business practice may take a while, as recently highlighted in a report by the Association of Fleet Professionals, which stated “The arrival of both electric cars and vans has highlighted the surprising number of businesses that still acquire vehicles largely by looking at the purchase price. This disadvantages EVs, which cost more to buy but less to fuel and maintain.“

This is the biggest constraint or concern of the four.

And it is forcing a strong linkage between transport and energy policies, and public-private partnerships to come up with workable solutions.

In simple terms, will the National Grid be able to cope, when we get back from work, and instead of the spike on the grid coming from the TV and kettle being turned on, it’s now multiplied by us all plugging our cars and vans in?

Projects are in place to look at this – options such as trickle feeds to vehicles during peak time, then full charge happening post midnight, for example

The other side is the charging options away from home or the workplace, to help extend range and reduce or eliminate range anxiety.

The UK Government as part of the National Infrastructure Strategy to support the uptake of EVs has announced a £1.3bn investment in charging infrastructure and grid capacity.

This aims to make motorway and A-roads, as priorities, sufficiently enabled with rapid charging points to meet the needs of long haul freight and logistics operators, as well as supporting those outliers who will max out on their range on certain journeys.

Another area that is being looked at is off-drive charging options for urban environments. Where running a cable from your house, over the public pavement to your car parked 30 metres up the road is not the best solution. For so many reasons.

And while all these concerns are being looked at from University research units to government departments, there will be dead ends and rapid redundancy in outcomes, as the dynamic and changing nature of the technology will no doubt make today’s decision irrelevant a year later.

In many ways, the infrastructure to support EV’s will be like a rapid replay of the industrial revolution where transport moved from cart, to canal to train.

Of course, with all the focus on decarbonisation and the transition to net-zero economies, things are going to change.

Established players and new disruptors will make breakthroughs that will make some or all of the concerns above, redundant or irrelevant by 2030, or sooner.

Key within that, and in many ways going beyond electric vehicles, is battery technology.

The charge rate of batteries, the power from batteries, the charge life cycle of batteries, and the supply of batteries are all parts of the conundrum.

As Elon Musk of Tesla recently tweeted, “Battery cell production is the fundamental rate-limiter slowing down a sustainable energy future. Very important problem.”

However, the landscape is changing all the time.

For example, The Guardian just this week reported on a breakthrough by Israeli company StoreDot, that will allow car batteries to be charged in the same time as it takes to fill up an ICE car with diesel or petrol – about five minutes.

These new fast charging batteries, by StoreDot or other companies, are probably only 2-3 years away from full market deployment.

And they will change the game.

If you can charge your EV in the same time as it takes to fill up with petrol, then how about those thousands of petrol stations up and down the country converting over to charge stations?

Allowing us to continue to “fill up” as we’ve being doing for the last eighty plus years?

And thereby helping eliminate a major hesitation or concern in the early and late majority moving to EVs.

While the appeal of charging at home will remain, the options that these new batteries offer, dismiss range anxiety and open up EV’s to be used “just like a normal car”.

Of course, there is another shift that is going to happen – that of tax revenues.

While the government is incentivising us to move to electric vehicles with lower or zero tax rates etc, and also providing infrastructure investment to support the transition.

In so doing it is also reducing or cutting off a major revenue stream for itself – namely taxation on petrol and diesel.

With nearly 58p tax on every litre of petrol sold in the UK, that’s a serious chunk of change.

About £30bn according to one report.

Indications as reported in Autocar are that the government is looking at options to address this changing dynamic, but no conclusions have been drawn so far.

But with a tipping point that could be only six years away, and a UK general election that has to be called by May 2024, the challenge is going to have to be addressed by this government or very early on, by the next one.

With our vision of a safer world, CMS only welcomes the transition to EV’s as part of the global strategy to address climate change.

Beyond that, EV’s will be both business as usual for our risk management solutions, and a new set of risks to be considered, aggregated, standardised, normalised and reported on to our customers of fleet managers and insurers.

For example, while driving an EV is not too dissimilar to an ICE vehicle, at the start there are enough differences – acceleration rates, noise levels, etc – to make driving somewhat of a new experience, and thereby increasing the risk factor.

Plus how the environment around the EV reacts will be different.

Will people be as aware of quieter EV’s in an urban environment as they are of say a diesel van getting near to them?

Will this create new risks for drivers to be aware of?

Also, the seasonal impact on EV’s could be quite profound in the associated risks they have.

Yes, all wheel drive will be more common, so driving in bad conditions should improve, but the battery drain when cab and window heating, plus more use of headlights are needed in the winter months, will be a new risk factor on the range of the vehicle.

Monitoring of this situation, in real time with alerts for fleet managers when battery levels drop below what’s needed for the planned route, is an example of a capability that our platform, Clara, could incorporate for our customers.

Helping them monitor their fleet situation and making interventions before things become critical.

After all, it is data, and data is what we do.

Finally, as with our conclusions on home delivery, while we can see a path and a new set of needs ahead of us, innovation and disruptive thinking will play a big part in this transition.

That will make the concerns and risk factors that can be seen now, lessened, while, perhaps, creating new and currently unforeseen ones.

Sitting in a unique niche covering fleet management, technology, risk management, workplace safety and insurance, CMS has some distinct perspectives on the trends coming to the fore this year and beyond.

Specifically, home delivery, the move to Electric Vehicles (EVs), AI & autonomous vehicles’ impact on Fleet Management, the game changing nature of 5G, and the changes we see in the insurance field, which in many ways is reacting to all the other developments.

Over the next few posts we’ll explore those trends and our views on what they mean.

The COVID-19 pandemic saw 2020 accelerate the oft cited move to a society of online ordering and home delivery.

What many thought would be the way we’d move to living by, perhaps, 2030, or beyond, happened almost overnight in March and April of 2020.

The enormous pressure this put-on retailers, logistics companies and the last mile delivery industry as they pivoted to adapt are still at play.

Delivery capacity planning, warehousing capacity, staff levels (to both grow and cover those made ill by the pandemic), are all being thrown into the mix while the overriding goal is to keep deliveries moving.

At a strategic level this has led to margin challenges as rapid investment has been needed into the supply chain elements both for capacity growth and also the safety of staff to work in Covid-secure environments.

As a related example, a major UK supplier in the food sector saw margins fall at the same time as demand ramped up at rates not seen before, from its supermarket customers, due to the increase in at home eating.

The margin investment it needed to make in creating Covid-secure environments across its operations, out stripped the boost from the demand spike. However, now the investment has been made, and demand is still strong, margin is returning.

By observation of our customers and the broader home delivery industry, CMS can see a bow wave of improvements and investments building up as companies look to the medium term of how they will work in this new reality. While also balancing the day to day need to keep service levels high.

This includes risk management, cost control, operational efficiency, and supply chain resilience testing & scenario planning.

The last being important as it turns out the World can change overnight.

However, behind this, the burning question is will this new retail model persist when mass vaccinations allow a return to “normal”?

Well, a survey by UK supermarket Waitrose found that 40% of the respondents planned to do more online shopping.

And a US logistics provider, LaserShip’s, survey of consumers found that the rapid uptake of online shopping at the start of the pandemic, by the Baby Boomer generation (those aged 55+), will continue, as nearly half (47%) plan to stay with their new ways of shopping, post pandemic.

All this indicates that the online-offline mix pre pandemic will be radically changed post pandemic. Meaning the uptick in home delivery and all that entails, is here to stay.

If that is the case then operators will be looking to optimise their fleet operations, be that with more vehicles, or smarter use of their existing fleet, or more realistically, a combination of the two.

One area of bleed over in-home delivery that has happened in the United States and may come to the UK is that of crowdsourced delivery.

With capacity maxed out in traditional suppliers, Atlanta based company Roadie has seen an increased demand for its part-time delivery solution.

This takes the friends and family approach of “I can drop it off for you, as it’s on my way” and through app-based technology creates a service that taps drivers already on the road, in their personal vehicles, and diverts them to a nearby store for pick-up and delivery.

Typically, orders are delivered within a few hours.

Roadie’s use by retailers surged with the pandemic, with usage in April rising between 151% to 1,456%, depending on retailer, over what it had been in February.

Given all we see from our home delivery customers in the UK and abroad, and a review of the trends, home delivery is not going to go back to what it was before the pandemic

The convenience, be that time saving or otherwise, is now embedded in our purchasing culture.

What will be interesting to see is how the market expansion affects innovation and disruption.

For example, Amazon’s prime model of “free” delivery is impacting the cost base of the industry, and leading to an expectation that delivery is included.

If that’s the case then what innovation and what disruptions in the marketplace will be needed and will occur as that core market assumption takes hold?

Lower cost home delivery methods – better stem and petal planning for van deliveries, the gig economy/Roadie model, and of course the next science fiction idea of delivery by drone.

All of these are on the table, as commerce will find a way given the opportunity that is now established.

2020 has been a year like no other.

As we near its end, with the promise of a resolution in the coming months, albeit with hard miles still to travel, all of us at CMS wish you the merriest of Christmas that is possible, and join the global well wishes for a happier new year.

With the support and confidence of our customers and partners we have both weathered the storm, so far, and grown our operations. For that we are forever thankful.

Over the holiday period our offices will remain open as normal, apart from the Bank Holidays (December 25, 28 and January 1), and the office will be closing at lunchtime on Christmas Eve.

Merry Christmas, Happy New Year and above all, Stay Safe.

Employee engagement is regularly seen as a key company priority and is a common senior leadership goal.

It is based on research that shows engaged employees commit longer-term to a company. They embrace its culture, are more productive and through this, contribute to the company’s overall success.

Well, while employee engagement is most often seen as a way of helping secure revenue goals, getting projects successfully across the finish line, and other methods of company growth.

It is also a powerful tool in realising the benefits of risk management, namely a reduction in accidents, incidents, failed projects, and the preservation of brand and company standing.

As such employee engagement, when motivated for risk management, is a powerful way to prevent or reduce costs, thereby adding to the company’s bottom line profitability.

In most organisation’s employee costs are 50-70% of the operating budget.

That is with, salaries, taxes, benefits, recruitment, equipment and training & development costs, a good standard metric is 50-70% of the organisation’s budget is related to its people.

As a company asset or investment, that’s a big one to tap into and leverage for risk management within your company.

Also, its one that is probably already being leveraged, through engagement, for the growth of the company – reducing staff turnover, improving productivity and efficiency, retaining customers at a higher rate, etc.

So, broadening its focus to cover risk management should not be too much of an additional management and leadership task

These four keys are not different to the standard parts of an employee engagement strategy.

But their use as a broader tool, one that brings in risk management, needs to be considered.

Plus, they may be tools that those charged, at a formal level, with risk management in a company, may not be familiar with.

Show employees how they can help make the organisation more successful, through risk management.

Communicate core values and the importance of risk management in updates and reviews, but most importantly through leading by example

Coach and mentor a culture of risk management at the team and individual level, and then acknowledge and celebrate examples of success to reinforce.

The importance here is to get senior management to champion risk management as something that is owned by everyone in the company, not just a department such as Health & Safety.

Train, coach and manage the team in knowing what to do.

Define, clearly, what the expectations, skills and competencies needed are, in a framework or roadmap of what is being worked towards, and (most importantly), why.

This extends to, or starts with, the recruitment process.

Sure, you recruit for the role and task, but at the recruitment stage, state the company’s approach to risk management, how it benefits everyone and how it is a key component in the company’s culture and measures of success.

Continue this in the training and development of the team, helping them continue to integrate a culture of risk management into their day-to-day activities and longer-term planning.

Of course, this is a two-way street, as opportunities for training and development are always topping the lists of what employees want from a company to feel engaged and valued.

Finally, support all of this with risk management being part of the overall management feedback process. Be that quarterly (better) or annually (weaker) and making it part of the day-to-day coaching and mentoring.

Obviously, this is where, in the case of fleet risk management and telematics data aggregation, that CMS can help, with our SaaS platform.

But as a general rule, you need to give your employees the right tools to do the job, and ideally, the best tools.

A blunt saw may cut faster with an enthusiastic user, than a sullen user, but a sharp saw and an enthusiastic user will get a far better result.

This approach also underlines the goal of employee engaged risk management, that of lowering or reducing costs.

If the right tools, be that software or hardware can reduce time, save on queries, give better insight (again all of what CMS does), then they will provide a return on investment that can be both measured in cost savings, and also by adding to employee engagement as the employees see how effective they can be.

Keeping your employees motivated has rewards in itself and is easier to do with an engaged team. But it is also an example of a virtuous circle, as maintaining impetus helps with engagement, and engaged employees drive the need and desire to maintain impetus.

This brings together all the points above – leadership, proficiency, and resourcing – and by keeping them front of mind and actioned, with a focus on risk management, employees will speak up, point out risks, work proactively to prevent incidents, deliver on cost savings, and help with reputation guardianship.

Obviously, you can’t force employees to be engaged, but by working the above strategies, you will provide an environment where engagement can seed, grow, and blossom.

It will then deliver benefits for the company, which can be summarised in seven areas.

All of the following points can happen without an engaged employee team.

They are unlikely to happen with a dis-engaged employee team, but equally they are more likely to be realised with an engaged employee team.

In essence an engaged employee team gets you there quicker and in a better shape.

They cover basic measures such as costs, long term standing such as company reputation, and internal areas such as employee attitudes and company culture

With a team of engaged employees, risks are reduced, repetitive issues identified and eliminated and from this cost and time savings will be delivered.

Further, as a company’s risk profile improves, medium term to long term savings will be realised in things like insurance premiums.

These savings all go to the bottom line, as £1 saved in a company delivering a good 20% operating margin, is the equivalent of £5 earned in revenue.

Many actions or risks involve a potential for affecting a company’s, or its brands, reputation and standing.

If something bad happens, customers, the public and the markets can take a negative view, damaging the company both in the short and long term.

With a culture of employees engaged in risk management, aware of what the negative side of the risk could be, there is a broader assessment of the risk, clearer decision making on the actions, and better planning for mitigating the risk.

This helps eliminate the not uncommon scramble to address the situation and the reputational fallout when things go wrong, of which there are many examples of.

Most companies don’t like surprises or unplanned events impacting their actions, projects and plans.

With a company-wide attitude of risk management the impact of the unforeseen can be minimised.

This is accomplished by reducing the number of unforeseen events, but also by alerting to their happening.

With an engaged workforce the attitudes of “someone else will spot it”, or “it’s not my place to say”, will be removed and employees will speak up and flag when something is wrong or heading that way.

Every company faces risks. It is an inevitable part of business and companies, leaders, managers, and individuals are often defined as risk adverse or risk takers.

However, many employees regard risk management as someone else’s responsibility or problem. But, by engaging employees on the benefits of risk management, this can be changed, and a whole ownership of the topic taken forward across the company.

Health and safety is everyone’s responsibility.

This is obvious in physical work environments such as construction sites, where huge strides in safety have been made in the last decades. But it also applies to the office environment, where risks are less overt, but do have the potential for real harm.

Again, a culture of employee engagement, encouraging all to look after each other, helps minimise risk and keep people safe.

Communication is oft cited as one of the top five major issues in a company.

No matter the size or structure of the company.

By having an engaged workforce, with a focus on risk management, another channel and reason for communication is opened.

Allowing for more discussion and dialogue both horizontally and vertically, and the breaking of the silo mentality.

The benefits of this will flow into other areas of discussion within the company as the internal networking is established and fed by the risk management dialogue.

While employee engagement is a key leadership and management goal in any company or organisation.

It is mainly desired as an asset that helps with company growth and revenue targets, that is it has an external bias.

However, it is equally valuable when motivated and internally focussed on risk management.

Here it can deliver cost and time savings, reduce the likelihood of reputational damage, and help foster an even stronger company culture.

One that helps further the employee engagement, creating a virtuous circle.

Our SaaS platform helps organisations take better control of their risk management in the areas of fleet operations and remote worker safety.

If you would like to find out more about how we can help, please contact us using this form or call us on +44 (0)345 241 9449

As we continue our business growth and team expansion plans, CMS is very pleased to introduce another new recruit, Nick Gautrey, our new Senior Developer.

Joining Team CMS at the end of October, Nick has a wide brief.

He’s working on the design and development of our data aggregating risk management platform, to meet the tailored needs of our customers.

Such as, TTC Group, a leading fleet driver training and risk management specialist, which powers its Continuum engine with CMS’ platform.

As our new Senior Developer, he’s also closely involved in the development work for CMS’ platform as a whole. Providing support and guidance to the development team, based on the knowledge and experience, picked up throughout his career.

Plus, he’s evolving the automated testing function within CMS.

As Nick says, he loves to innovate and is continuously looking for ways to improve things.

Which is a great attitude and one that chimes with our culture and values, here at CMS

Working for close to a decade now, Nick’s experience has primarily been as a .Net Developer.

In this capacity he’s worked across a broad range of company cultures from the fast paced everything now ones, to the more measured environments, where everything has a process.

This has included such diverse industries as supply chain management, payment processing, and the IoT Cloud. The last of which he says is closest to what CMS does, but Nick also sees relevance from the other roles, to his work at CMS.

As is now the way, Nick joined us in lockdown, and of course few of us have met him in person.

However, like many are experiencing, the new norm of Zoom and Teams calls mean that Nick has rapidly become part of Team CMS. With Nick seeing similarities in our company culture to that of his sporting passion.

More on that in a short while.

Of course, who knew, way back in early March, that company cultures could successfully adjust so rapidly and still be as strong?

Boxing.

Nick loves the sport – it keeps him fit and healthy, has taught him the importance of focus, hard work, and, perhaps surprisingly, teamwork.

As he says, the boxing gym is like a big family where everyone helps each other achieve their goals. And while you are alone in the ring, during competition, the camaraderie in the gym, where most of the time is spent, is incredible.

It is this camaraderie and big family culture that Nick has likened to CMS’ culture.

After the boxing is over, Nick loves to cook.

Picking up on his trait of innovation, Nick enjoys working up new recipes, and trying creative approaches to traditional meals.

Well, with his love of boxing, there are no prizes for guessing Nick’s favourite films. The Rocky series, of course.

THE actual favourite amongst the eight-film boxing series is Rocky IV.

That’s the one where Rock takes on Ivan Drago, from the Soviet Union. It features a surprising plot twist, which sees the Italian Stallion get beaten in every round, to then take the win in the final round. ?

Of course, given his love for the series, I don’t think anyone has asked Nick what he thinks of the sequel, Rocky V. That’s the one with Tommy Gunn and is normally as well regarded as The Godfather part 3 is.

When not watching Rocky films, and when situations allow, Nick’s idea of a good night out is to either meet up with his mates at the Pub, to play a few rounds of pool (“I get beaten all the time” he says). Or venture out for a Thai meal, to quench his love of spice.

Perhaps we should mention that one of the best Thai restaurants in Milton Keynes is just around the corner from CMS’ offices. Or maybe that was part of the reason Nick joined us?

As with all our recent recruits, Nick is a very welcome and warmly welcomed addition to Team CMS. And as with those before, he is already delivering results for you, our customer.

Both safety and security in the supply chain can be improved through the use of connected vehicle technology .

However, to be truly effective, in CMS’ view, a best practice method for adoption is this four-step process, which is as much about management as it is about the capabilities of the technology.

The four steps are:

Connection

Collection

Analysis

Action

By adopting these four steps, commercial fleets, insurers, and transport management companies can improve the safety and security in their respective supply chains.

Each of these steps will be explored and detailed below, but first some background information on the technology that supports this, commercial vehicle telematics/connected vehicle technology, and the market challenges that are encountered.

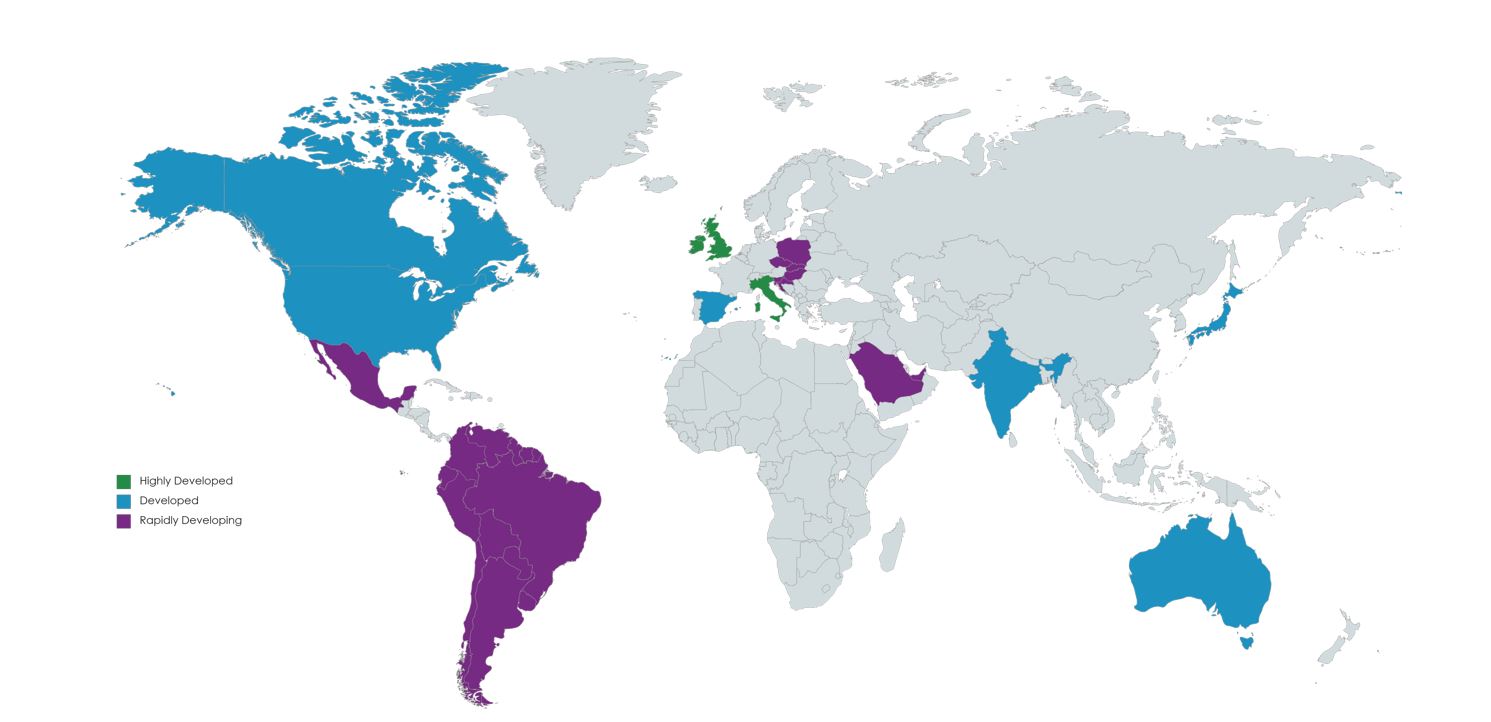

In terms of competition, breadth of deployment, and use of technology in commercial fleet management, the UK and Italy are regarded as the World’s most highly developed connected vehicle markets.

That is the numbers of suppliers in the market, the level of connection geographically and by devices/capita. The penetration of the telematics technology into fleet management, and the deployment of the latest technology, are all at the highest levels in the UK and Italy.

Behind these two countries, North America, Spain, India, Japan, and Australia can all be characterised as being mature and developed telematics markets, but at a level that is behind that of the UK and Italy.

Latin and South America, Central Europe and Saudi Arabia are the regions and countries that fall into the next category. That of a rapidly developing connected telematics markets.

The other parts of the world, while using telematics solutions, have not reached the same level of market competitiveness, business penetration, and/or use of connected telematics. This is down to a myriad of reasons ranging from infrastructure capabilities through to workplace cultures to (lack of) government legislation.

In terms of market size, the global commercial vehicle telematics market has been assessed at £3.6b in 2019, with a 2025 forecast of £4.5b.

The factors driving this growth are increasing safety and security needs, both in the form of corporate responsibility and government regulation. The falling cost of connectivity and the increasing market penetration and integration into connected vehicle systems of smartphones. Plus, a broader appreciation of the benefits of using connected commercial vehicles for cost savings, fleet operational efficiency, improved customer service, and overall business competitiveness.

From CMS’ point of view, based on our working with customers and partners around the world, we see five strategic challenges to the deployment of connected vehicle technology. These have a strong correlation to the maturity of the market.

In rapidly developing markets, the availability of the technology and the constraints of installation and deployment are the main challenges.

As markets become more developed, the scaling up of the technologies deployment and the associated costs become the main challenges. As this is overcome, the next challenge, that of the legal use of the data, comes to the fore.

This leads to industry, government and community dialogue about, and legislation around, the lawfulness, fairness, and transparency of the data.

Including the limitations of the purposes it can and can’t be used for. The accuracy requirements and minimal levels of the amount of data that can be collected. The storage security, integrity, confidentiality, and time limits of the data. And ultimately, where the accountability for all these elements sit.

As markets become highly developed, this legal use of the data, rather than the availability installation and deployment of the technology, becomes the main challenge. With all the elements becoming part of a whole, namely that of concerns over data protection.

Here, what data is collected, how, where, what, and why it is used, are defined. The debate and challenge shifts to how that data is protected from its being used by unauthorised third parties.

Of course, there are many additional challenges to do with the tactical deployment and use of connected vehicle technology, such as dealing with the sheer amount of data generated, and these will be highlighted in the sections below.

The first step in using technology to improve safety and security in the supply chain is the connection.

Connected vehicle technology can be grouped into three generations.

Each shows how the type of data that is available and collected by the connection has evolved, meaning that even more insight and management information can be used in security and safety efforts.

Of course, many fleets are at different stages with the hardware they deploy, with a combination of technology generations being common both in and across the categories of hardware.

For example, a fleet could have the majority of its vehicles using 2nd Generation black boxes, but be upgrading to 3rd Generation as it onboards new vehicles, while also staying with a policy of using just two cameras (i.e. 2nd generation) across the whole fleet.

By hardware type the generations are:

1st Generation: GPS system to track the vehicle’s location. From this gives speed, route, mileage, drive times etc and is used for route planning efficiency.

2nd Generation: GPS plus events. An evolution of the basic GPS system, which now records events such as harsh breaking, and rapid acceleration, giving an insight into the driver’s behaviour.

3rd Generation: GPS, events, plus diagnostics. Records as per 2nd generation but now integrates vehicle diagnostics and reporting, plus elements such as door opening and closing, engine load and idle times, and the use of seatbelts.

1st Generation: SD Card based, and as such, not connected. Require a manual process of taking the cards out of the camera and vehicle and passing onto the fleet management team. Useful in dispute resolution and related insurance claims, but not a real time solution for security and safety.

2nd Generation: Fully connected cameras, with upto two deployed in the vehicle – often with one looking out of the cab and one looking in the cab at the driver to monitor behaviour and look for warning signs such as drowsiness.

3rd Generation: Connected ADAS (Advanced Driver Assistance Systems) with upto eight cameras placed around and inside the vehicle to both help drivers and record events and incidents. This is the standard that programs like London’s Direct Vision Standard are fostering on the fleet management community.

1st Generation: Apps that have to be activated by the user before they come online, and using the sensors (accelerometers, GPS) in the smartphone to gather data.

2nd Generation: Auto-activating apps that are linked to the vehicle’s internal systems and come online automatically when the vehicle is started up. Still using the internal sensors of the smartphone for data generation.

3rd Generation: Apps with Bluetooth Tags – a smartphone app that is working with sensors placed around the vehicle, communicating via Bluetooth. This turns the app into a sophisticated monitoring and reporting solution, that is connected via the phones data, and expands immensely on the data that the smartphone can gather internally, providing an alternative to the established Black Box solution.

1st Generation – No examples of these, corresponding to 1st generations of the other hardware items

2nd generation – wired sensors reporting back to the Black Box. Not directly connected themselves and reporting on things such as temperature levels in a refrigerated truck. These require a physical connection (wired) to the vehicles black box to transmit the data out of the vehicle

3rd generation – wireless sensors using a SIM to communicate directly, allowing for the deployment of a range of sensors that do not need to connect to the Black Box for transmission of data.

Within these generations, there is also a move away from the need for a dedicated Black Box solution, to more tailored and specific options for the fleet operator, through the use of 3rd Generation cameras, smartphone apps and ancillary sensors.

In essence as the technology has developed the flexibility and range of the solutions available to the operator has increased.

While this comes with the issue of more data from more sources, all of which needs to be compiled, monitored and analysed, it does give the options for very specific solutions to meet the security and safety needs of the operator.

Beyond the 3rd Generations, the next technology jump will come with the deployment of 5G networks.

The logarithmic increase in speed and bandwidth that 5G will bring, changes the nature of the data flow both from and to the vehicle.

Vehicle to vehicle, and vehicle to infrastructure communications become possible, moving the ADAS and autonomous vehicle models forward.

More sensors can be placed on vehicles, and be connected over the network, reporting in real time. Giving operators an even greater range of solutions specific to their fleet management, security, and safety needs.

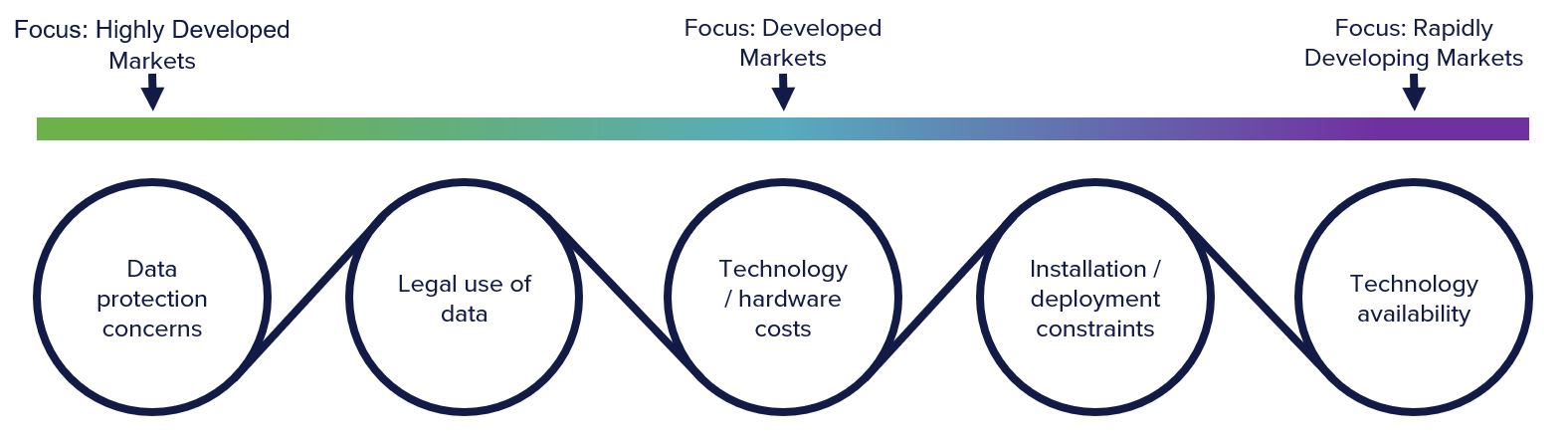

The second step in the management process for using connected vehicle technology for better security and safety is the collection of key data sources.

While the connected vehicle is at the heart of the solution, other sources are just as key, in CMS’ experience, if the operator is to get a full 360-degree view of the risk profile.

As such we recommend incorporating employee, dispatch, and checkpoint/security information into the data mix, along with the established telematics and maintenance information.

Of course, this is more data to add to the data lake, for processing, comparing, and analysing. But without incorporating the latest driver training records or performance review, the assessment of that driver’s risk-based security and safety is missing a major slice of the picture. Which could, at times, be the crucial element.

While the technology exists to gather all sorts of vehicle information, in real time. And most companies have good additional records on their employee’s performance, which can be incorporated into their fleet risk management program. All of this fails to have an impact if the wrong questions are asked of all this data.

CMS’ work in fleet risk management, has highlighted that simple questions are the foundation of what needs to be asked.

By asking these the areas of fleet security and safety which need action, can be identified, drilled down on and the actions that follow from the analysis be more effective.

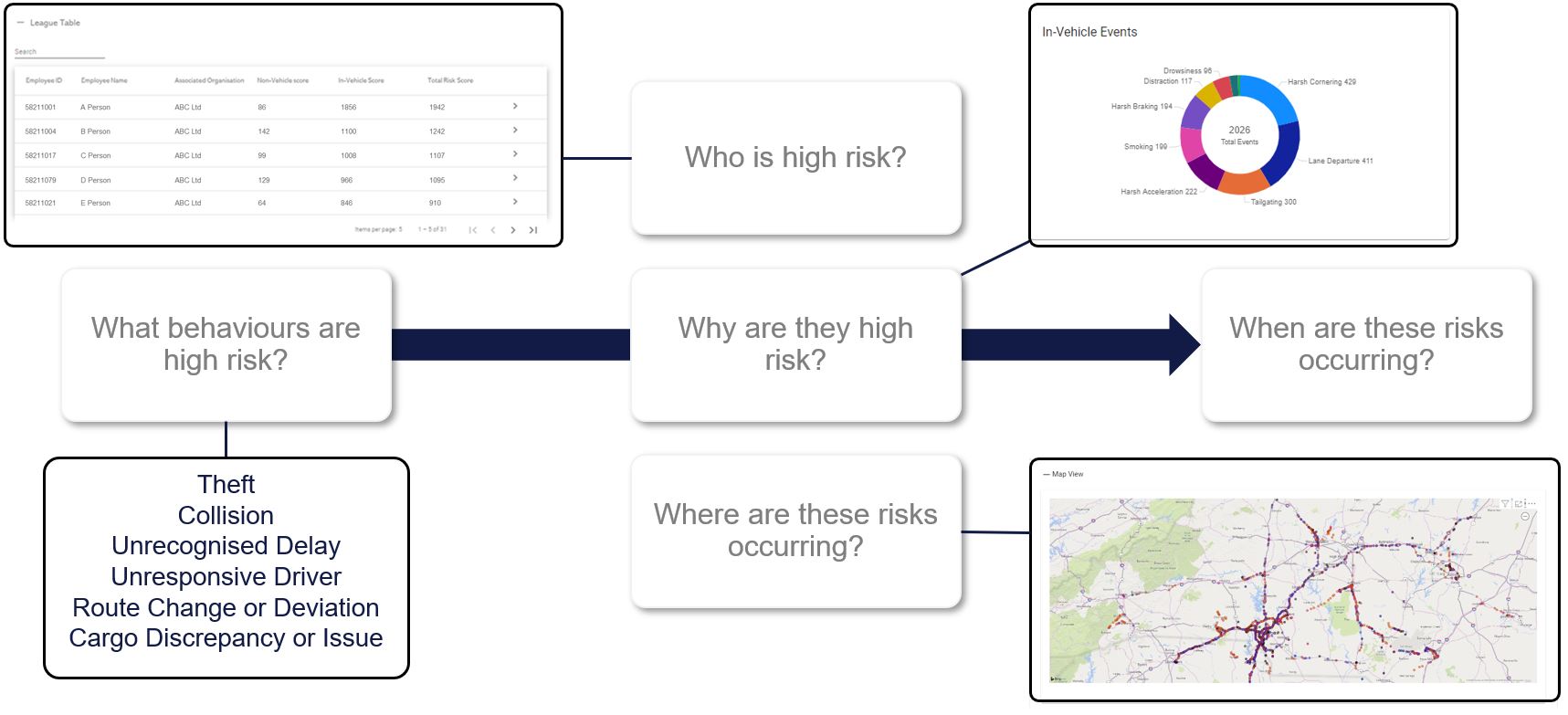

Examples of these simple questions are

Who is high risk?

What behaviours are high risk?

Why are they high risk?

When are these risks occurring?

Where are these risks occurring?

By focussing on these questions, large gains in security and safety can be made.

The final step in the management process for improving security and safety in the supply chain is, unsurprisingly, the most important one. Take action.

It is the step of effective monitoring and then acting on the data insights to keep people, vehicles, and cargo, safe and secure.

Again, based on CMS’ experience, the best way to do this is to have a dedicated team that is monitoring the data, responding to the insight, verifying the situation with the drivers, and then updating the management process with the outcome.

Of course, this vital step is built on the previous steps of connecting, collecting, and analysing the data. But without it, these steps are irrelevant.

Also, while the actions taken in this step are very much facilitated by the technology deployed, they are also a management task. As such the outcomes at this step are as much about the quality, training, management and leadership of the team, as they are about the technology supporting them.

Connected vehicle technology, or telematics-based solutions, are a great facilitator in improving safety and security in the supply chain.

As the technology develops, its capabilities for tracking, measuring, assessing, and providing insight are growing. This will take a major leap forward with the coming implementation of 5G.

However, in CMS’ experience of fleet risk management, and working with connected vehicle technology, the management structure facilitated by the lakes of data and insight that the technology creates is as important, if not more so, than the technology itself.

Great technology with poor management will give a poor result. OK technology with great management will give a better result.

So, as much as we pride ourselves on what we can do with aggregating, standardising, and normalising connected vehicle and non-vehicle data. We’ve also learnt that the management processes behind fleet risk management are as vitally important if safety and security are to be improved.

The above CMS Insight is based on a presentation by our CEO, Charles Smith, at the Expoportuaria 2020 conference.