Telematics data aggregation is one of those “it does what it says on the tin” capabilities.

It is the bringing together of the mass of data that is generated by telematics devices, dashcams, black boxes, apps and, increasingly, wearable devices, into a useable solution.

The solution is normally a software, and one that is cloud based.

It also helps immensely if the telematics data aggregation software is hardware agnostic.

That is, it can take data from any connected hardware, regardless of the data protocols that the hardware is running on.

And if it can do that, it needs to be able to not only aggregate telematics data, but also standardise and normalise the telematics data for consistency and comparison.

Given all this, telematics data aggregation is seen as a part of the Big Data, Machine Learning (ML) and Artificial Intelligence (AI) developments. Which are now taking hold in business, commerce, and society.

While it is a relatively new field, it is one that is only set to grow in importance. As telematics data aggregation services become a key facilitator for transport managers, fleet managers, insurers and risk managers seeking to make the best use of the big data that their telematics systems are generating.

There are two key reasons why we need telematics data aggregation.

Is that most fleet operators and insurers have more than one telematics system in use.

This could be from different hardware vendors, the Telematics Service Providers (TSPs), or they could be upgrading from one model to a newer one. A process that can’t be done overnight on a fleet of several hundred or thousand vehicles.

The point being that they will be collecting telematics data from more than one data source. And many times, these data sources won’t be truly comparable or consistent.

And more pressing need, for telematics data aggregation, is the sheer amount of data that is being generated.

We wrote about the phenomena of “Too Much Telematics Data” recently.

As a synopsis, the amount of data that is being generated is huge and will only get bigger. Because our vehicles are no longer self-contained mobile boxes. Instead they have become very sophisticated data platforms generating, transmitting, and receiving a mass of digital data.

Is a phrase often heard from transport managers and fleet managers, seeking to get on top of the data they are getting. So that they can gain insight to do their job of managing their fleets on a day to day basis (see here for more about fleet management).

It expresses the problem very well, if somewhat graphically.

As a 2018 report by Ptolemus, a specialist consultancy in connected mobility, on telematics data aggregation, put it:

“While the amount of data generated is growing at a phenomenal rate, the quality of data analysis and actionable insights delivered to the fleet operator have not developed at the same pace. More data does not automatically translate into more value.”

Or as Jorge Fernández, from Roche, 2019’s Global Fleet Manager of the Year, said;

“It would be good to develop platforms to simplify and aggregate services in order to help fleet managers”

So, in this case, telematics data aggregation is designed to take the problem of too much data, away from the fleet operators and transport managers. Replacing it with clear and simple insight, management information and alerts. Such as FNOL (First Notification of Loss). Which will enable them to be both more efficient and effective.

In this situation, as the Ptolemus report says, “It no longer matters who generates the data – what matters is who can provide the clearest insight into that data.”

Particularly those insurers providing services to light commercial vehicle (LCV) operators. The need is like the first reason above. Telematics data aggregation for bringing data together from a range of different TSP devices.

With this capability, insurers can use telematics data aggregation as a value-added service to their customers. Using it as a source of information which can help refine, improve, and evolve the insurance business model and the claims process.

Which neatly brings us on to the benefits of telematics data aggregation.

The core benefit of telematics data aggregation, as highlighted above, is the efficient and effective compiling of telematics data to provide simple, easy to use insights for fleet, insurance, and transport management.

The point is worth restating.

Telematics has revolutionised the fleet and transport industries in the last decade. But with it has come a situation of multiple reporting, inconsistent data, and a new management task of staying on top of the data and the reporting.

This point is highlighted and expressed in a recent conversation CMS had with a fleet operator in the UK:

“One of our biggest barriers is the multiple systems we use, with little integration, the duplication of workload, multiple data entry, and no clear insight of trends and drivers of activity”

So, the core benefit of telematics data aggregation is taking away this management task. Replacing it with clear insight for management action. Rather than management being lost in the activity of just being able to understand the data.

But what are the other benefits of telematics data aggregation?

Well, they all stem from this core benefit of being able to manage better. Be that in identifying training needs by driver or depot. Being alerted in real time to FNOL or traffic incidents. Or being in better control of maintenance schedules and plans.

From an insurers point of view, having real time FNOL alerts allows the insurer to proactively take charge of an incident, rather than reacting to a call from their insured party. A call that often happens a good while after the incident.

And as we know, faster action leads to better cost control and management when it comes to incidents

For the fleet and transport manager, real time FNOL alerts help them in their duty of care for their drivers/employees. Alerts them to any logistic or delivery issues they may need to update customers on. And, if working with their insurer, can help bring insurance premiums down as average claim costs become smaller over time.

This management benefit can be extended further within the organisation.

For example, as a tool for enhanced risk-management, telematics data aggregation can be used to help guard brand and company reputation.

By having insight on near misses, problem routes, and problem drivers, management resources can be targeted at these areas. By doing this, things will improve, and the risk of an incident happening will decline. Plus, if one does happen, having proof of processes of risk management can help immensely with official procedures and investigations.

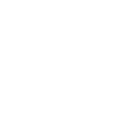

At CMS we summarised these benefits into this staircase, which we feel captures the benefits of telematics data aggregation. It also shows how the benefits go beyond the fleet and transport managers and their offices:

Telematics data aggregation is for any organisation that is facing the management burden of too much telematics data, not enough time to process it, and not getting the best from their investment in telematics.

At CMS, we work with fleet and transport operators and insurers. We also focus on these distinct operational businesses

Home/Parcel Delivery

Middle mile distribution

Heavy Industry

Utilities & Energy

Construction

Pharmaceutical distribution

Our findings are that given their operations of predominately light commercial vehicles. The fact that journeys will rarely be regular repeats for the drivers. Their travelling through the urban, suburban, and rural road networks. Plus, their investment in telematics. They have a real need for telematics data aggregation, as these combination of factors will give them both lots of data and lots of alerts.

Additionally, organisational values, duty of care and wanting to keep their people safe, also provide a need for telematics data aggregation services. Which goes beyond the direct need of the fleet and transport managers.

Telematics data is provided either in real time from a connected system such as a modern dashcam, or via a regular upload when the vehicle is back at depot. Obviously, this second method is of an older variety, is not necessarily automated, and has a delay built in.

Also, we are predominately talking about after market or third-party telematics installations, in the vehicles. While vehicle manufacturers do generate a lot of telematics-based data from the factory fitted devices, this is not normally made available to the fleet operator or insurer. This may change in the future (see below).

So, you have a number of telematics data sources, how do you aggregate them?

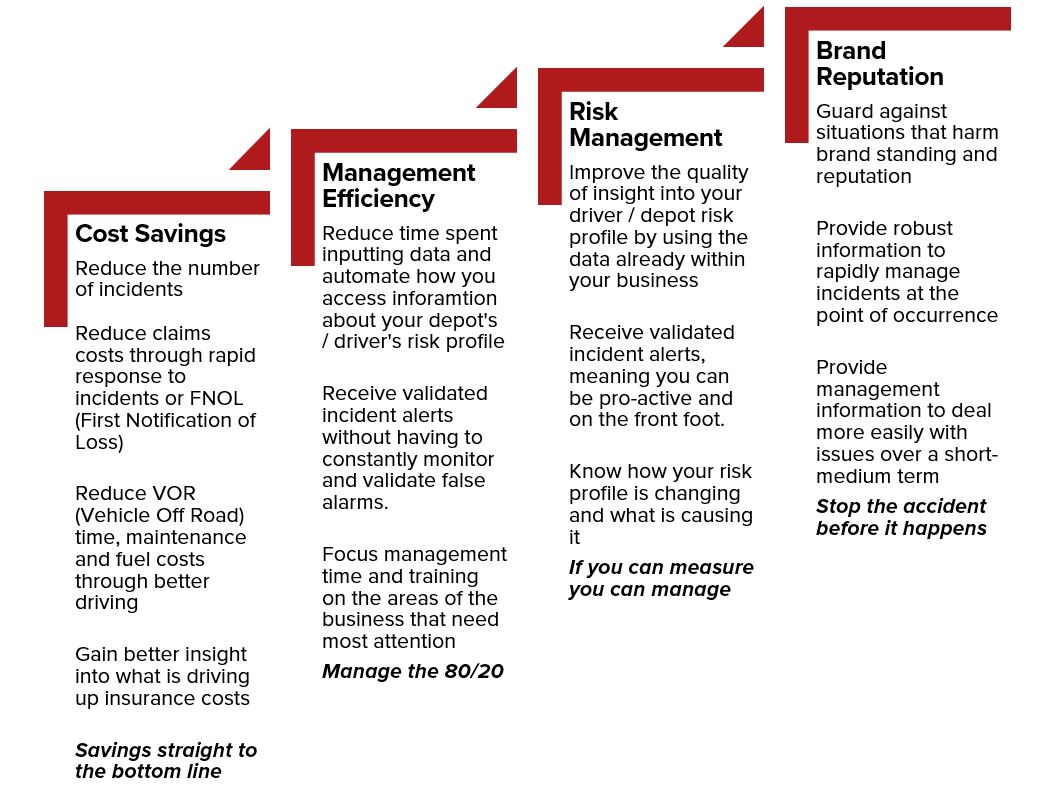

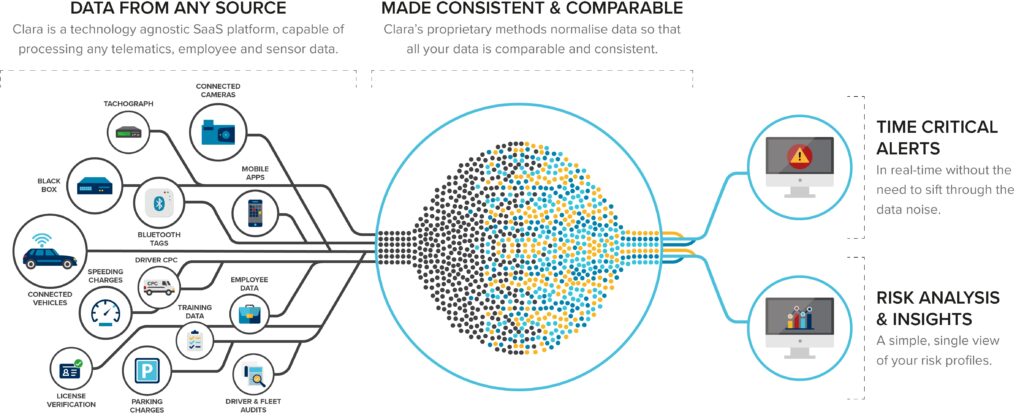

Well, the simplest way to explain that is to show what we do at CMS, with this handy graphic of our process:

Effectively there are four stages.

Stage one: Aggregation of the data from the telematics devices, and in our case, a range of other data sources such as training information, employee reviews, and speeding fines.

This is a combination of real-time feeds from telematics devices. Daily uploads from the older systems. And digitised data from the company and employee records.

Stage two: all this data is then standardised through our big data and machine learning processes. Making it consistent and comparable.

This part is key, as it removes the false alerts, the inconsequential data, and compares the data sets.

Removing all the information that, through big data and machine learning, is irrelevant.

Leaving just the key information that the user needs.

Saving them time and empowering them to act rather than be overwhelmed with a flood of telematics data.

Stage three: with this cleaned and consistent data, the user is alerted to just the incidents that need their attention (FNOL).

Rather than being lost in the mass of alerts.

Stage four: feed valuable data into the user’s risk management process for training and management focus.

Telematics data aggregation IS effectively the future of telematics data.

The capability to bring in data from multiple sources, clean it up and provide actionable insight is, arguably, more important than the tools to create that data in the first place.

That is, the current model of telematics service providers focussing on hardware is going to be secondary to the capabilities of the (software) management system the telematics data is fed into.

Additional features of the future for telematics data aggregation are:

This is a given.

As the number of devices grow, the quality of the images from dashcams moves from SD to HD to 4K, and things like the London Direct Vision Standard, requiring operators to have more devices on their vehicles, come into force, the amount of data is only set to increase.

A related challenge to this will be the bandwidth and processing power needed to gather and work this data.

This is an area that will grow, as traffic and route data, communications, and entertainment data are all fed into the vehicle.

While this may not at first be an area for telematics data aggregation to be concerned with, the data going in will have an impact on the actions of the vehicles and the data coming out.

Being able to match and understand that relationship, speed of response, value, and impact etc will become a valuable metric for telematics data to understand.

Related to both of the above.

Driverless vehicles, creating and processing data from other vehicles (V2V) and their surrounding infrastructure (V2I) is set to make the data oceans we face today seem like puddles.

The process and approaches being used in telematics data aggregation now will be a useful and powerful place to start from when approaching this new data mass.

Currently most, if not all, vehicle manufacturers don’t make the telematics data they gather available for fleet operators to use.

That is why third party aftermarket telematics devices are so prevalent.

This could be set to change as we move towards autonomous vehicles, with cameras and other sensors being built-in, and the need for shared access to V2V/V2I communication becomes a necessity.

As this happens, fleet operators will be spared the cost of having to invest in aftermarket installations, potentially.

However, if they are running a fleet of say Renault, Ford and Mercedes vans, they will still need a telematics data aggregation service to bring the data together for them and provide the management insight they need in one system, rather than across three separate ones.

Data privacy is a mainstream topic, and telematics data aggregators work to meet the needs of things like GDPR and employee concerns. Of course, the regulatory environment can change, meaning that the telematics data aggregators will need to change with them.

Additionally, as big data and machine learning come under more scrutiny, there will be a need to explain and detail what and how the decisions are being made from the aggregated data.

Regulators will become reticent to let machine learning make important decisions, as things become more automated, without some understanding of how and why those decisions are being made.

This will also extend to customers.

There is value in the aggregated telematics data, beyond its use by fleet and transport managers.

For example, local and national government could use the data to prioritise road network improvements and repairs.

Or retailers could use it to plan advertising campaigns from electronic billboards, based on the demographics of the drivers by route.

As the richness of the data increases, and the simplicity of its access grows, because of data aggregation, there will come a time when someone will either offer it as a commercial product, or someone else will enquire about purchasing it.

Regulation aside, at that point the value of aggregated telematics data steps into a whole different realm.

The simple answer is it’s what we do, the technical insight we were founded on, and all that we focus on.

We, therefore, have a depth of experience and expertise that is at the forefront of the telematics data aggregation industry.

But overarching this, our purpose is to address the challenges of connected data and with that, help make the world a safer place.

As an expression of this, CMS’ business and our solution is grounded on these three guiding principles:

Our approach is to combine telematics data with any other relevant data the organisation has.

Such as training plans, driver reviews, and traffic offences.

To create a fuller picture of the risk factor at driver/employee, depot, division, and organisation levels.

From this, our focus is on providing clear actionable information to enable users to answer four principal questions:

One: Is my organisation’s risk profile going up or down?

Two: What behaviours are causing this change?

Three: Which employees or drivers are the biggest contributors to my risk profile?

Four: What incidents are occurring right now that I need to respond to?

As a result, the platform to do this, our telematics data aggregation, risk analytics and incident detection software, is used by fleet operators, and insurers across the world.

Enabling them to

By utilising their data to automatically identify and intervene with high risk drivers, and reduce incident frequency.

Through receiving real-time, accurate collision alerts without having to review large volumes of false alerts.

By accessing consistent and comparable connected vehicle data from any new or existing installed telematics system.

Many CMS customers use our platform to score all the risk data they have, for targeted training intervention.

All of this gives our customers the power to transform their duty of care, claims and risk management programmes for drivers & remote workers.

Thus, reducing claims frequency, costs and making for a safer world.

If you are a faced with too much data from your telematics systems, or wish to improve your risk management process, then a chat with us would be a great place to start.

We have helped fleets and insurers manage their data in the most efficient ways possible.

By collecting their telematics data, camera footage and HR related data direct from all their sources, then aggregating it and standardising it and displaying it all in one system they have all seen a massive ROI in the first year.

If this sounds of interest please call us on +44 (0)345 241 9449, email us at info@18.133.239.125 or fill in the contact form here

CMS is incredibly pleased and proud to have been shortlisted as a finalist in all four of the categories it entered in the Insurance Times Tech & Innovation Awards 2020

“The IT Tech & Innovation Awards 2020 celebrate the very finest in UK general insurance technology and innovation – those outstanding initiatives, individuals and teams embracing emerging opportunities and leading the charge for a better customer experience in a rapidly changing space.”

– Insurance Times Tech & Innovation Awards website

Entries had to be in by 16 June and the finalists were announced on 6 July.

The awards ceremony itself, is planned to be held at the Royal Lancaster London hotel, which overlooks Hyde Park, on Thursday 17 September.

Obviously this will be subject to the advice on gatherings, because of the COVID pandemic.

In all, there were fourteen awards categories, that could be entered;

This category is about how artificial intelligence has been used to enhance customer service, drive marketing initiatives, develop new product and/or achieve improvements within the entrants organisation.

The category is all about recognising those organisations that have embraced new technology. To make a difference to their customers’ claims experiences.

Adding value via data analytics, is what this award category is all about. It’s a sister award to the AI award. And is about how data analytics have been used to enhance customer service, drive marketing initiatives and/or deliver business operational improvements.

This category recognises the value of creative thinking and innovation, in the risk-modelling world. It includes those companies which have modelled a new risk or developed a new way of helping customers gain a deeper understanding of their risks.

Due to the current circumstances, Insurance Times won’t be running the normal Stage Two judging day. That is face to face presentations to the judging panel.

Instead, finalists have been asked to provide an evidence-based written submission in the form of a 500 word ‘elevator pitch’, by July 30.

This will be reviewed by the expert panel of judges, meeting remotely themselves. On Thursday 13th August. To decide on this year’s category and award winners.

As mentioned above, the awards ceremony is planned to be held at the Royal Lancaster London hotel. On Thursday 17 September. With a Black-Tie drinks reception, gala-dinner, and party evening

Photos from last year’s event can be found on the IT Tech & Innovation awards website. Hopefully a similar evening will be possible, in the UK, by mid-September.

Obviously, all of us at CMS are very pleased and extremely proud to have been shortlisted for not one, but four IT Tech & Innovation Awards 2020

Our CEO and founder, Charles Smith, summed it up, saying

“This is great news for Collision Management Systems, and testament to the hard work of everyone in the company.

CMS is all about enabling a safer world. And we do that in three steps, which the IT Tech & Innovation Awards 2020 recognise the value of;

Simplifying data: CMS makes the complex world of telematics and connected vehicle data simple, clear and actionable

Empowering action: We enable organisations to make greater use of their data to manage risk better, act quicker and keep people safe.

Delivering trust: We are trusted by our customers because of our reliability, discretion and above all, our shared commonality of purpose: a safer world

It has been fantastic to be able to present these commitments and values, to the IT Tech & Innovation Awards 2020 judges, and to have them recognised as worthy enough to be shortlisted.

We are all now very much looking forward to the awards evening itself.

While we hope to be winners, we also want to acknowledge and recognise the work of our fellow finalists. Plus, the recognition and profile that these awards have in the Insurtech community.

And, of course, may the best organisation win on the night.“

Based in Central Milton Keynes, CMS is a world leading telematics data aggregation specialist.

Collecting data from connected vehicles and other data sources, CMS powers risk management solutions for the fleet, insurance, technology, and mobility industries, across the globe.

With this, we are very much about, enabling a safer world.

We are now looking for several Senior Software Engineers to join our development team, as CMS continues to grow

In the role you will be supporting the active growth of CMS’ Platform and the delivery of new features for our customers.

Our platform aggregates, references, standardises, and normalises data from any connected vehicle (telematics or camera), company or person, no matter the sources.

With this, it provides clear actionable information, insight, and alerts for our customers. Enabling them to keep their people safe.

If working on this platform, and sharing our goal of enabling a safer world, appeals to you. Then, to be considered for one of these Senior Software Engineer roles, you will need to have at least ten years’ experience in the full software development lifecycle.

Additionally, you will have demonstrable key skills and experience in C#, .Net, RESTful APIs, plus recent experience using cloud based microservices and function apps, ideally Microsoft Azure.

As part of our forward-thinking dev team, you will collaborate in the Agile Sprint-Scrums, have worked with JIRA, and be able to balance self-management with working closely with the broader CMS team.

But above all, like all of us at CMS, as one of our Senior Software Engineers, you will relish the exposure and accountability that comes with working for a small, fast-growing, tech business, that is enabling a safer world.

If this sounds like you, we’d like to have a conversation.

Please contact us on 0345 241 9449 or send your CV via our Join Our Team Page

Let’s get the conversation started.

Based in Central Milton Keynes’ Witan Studios, CMS is a world leading telematics data aggregation specialist.

Collecting data from connected vehicles and other data sources, CMS powers risk management solutions for the fleet, insurance, technology, and mobility industries, across the globe.

With this, we are very much about, enabling a safer world.

Following on from the recent recruitment of our new Scrum Master and Web Developer, Jon and Sam, CMS is very pleased to welcome another new starter, Scott Whitmore. Our new Cloud Platform Engineer.

Like Sam, Scott joins us in lockdown, so most of us have only met him on Zoom and Teams. However, we can confirm that he does have a passing resemblance to a young Gandalf, with those long locks of hair and a beard.

He has assured us that this is his normal look, and not something to do with the scarcity of hairdressing options for the last one hundred days.

Well, like Gandalf, he’s also very wise.

Having joined us in early June, Scott has already delivered a fair chunk of savings and efficiencies on our Cloud Platforms.

Plus, with his keen eye on the industry, alerted us all to the Lucifer malware currently doing the rounds, and to keep our vigilance up against such threats.

As our new Cloud Platform Engineer, Scott’s job is to is to plan, manage, maintain, and implement cloud-based solutions for CMS, in support of you, our customer.

Primarily this is in Microsoft Azure. Which is our cloud provider of choice for our Risk Management SaaS platform.

Given the incredible complexity, scale and range of services offered by Azure, Scott’s job is to find the right options for CMS to provide our systems, 24/7, to you. That’s both for today, and as things scale and change, in the future.

With Scott’s skills, we can better support customers in the UK, the Americas, and across the globe, with the benefits of our platform. That is, risk management, real time FNOL alerts, and ultimately, enabling you to keep your employees safe.

Well, he’s been working in IT for six years, now, and specifically with Cloud systems for three years. Before joining us, Scott worked at Northampton based Connexas, a telematics solution provider to fleets.

So, not only does he have the Cloud Engineering skills we need, but also industry experience and insight. This will help us continue to grow and support you, as the world’s leading telematics data aggregation specialist.

Well, probably unsurprisingly, Scott spends his spare time tinkering with software and playing videogames.

That said his favourite hobby is playing the guitar.

Something he’s been doing for over fifteen years. And if you ever get onto a Zoom call with Scott, do a “Where’s Wally?”, and look for the space behind him that doesn’t have a guitar in it.

As he says, like all good collectors “Some of the time I think I have too many guitars. Other times, that I need more”

Probably from the same aspect as his love of guitars, and the tinkering with software, Scott has an introspective side.

This finds him visiting and loving peaceful, serene places, such as mountains.

Sadly, with few of them near Milton Keynes, the last place he really enjoyed visiting was Llyn Cau, Cader Idris, in Wales.

Chilli.

Chilli is Scott’s favourite food. He loves the spice and flavour. Plus, the best way to eat it, he says, is served in bread as a chilli-based version of a Bunny Chow.

On top of that, Terry Pratchett is his favourite author. With “Guards! Guards!” and “Small Gods” fighting for first place as his fave book.

Scott also has a guilty pleasure (who doesn’t?) of loving cheesy action films, with barely understandable protagonists (looking at you Sly).

Of the genre, Demolition Man stands head and shoulders above the rest. Yep, a guilty pleasure indeed.

Finally, when asked “Who the most famous person he’d ever met, was?” Scott replied that Michael Palin, while maybe not the most famous, was the best most famous person he’d met.

Michael cheered Scott up with a good long chat and a parting hug at a book signing event.

Scott assures us he avoided mentioning anything about dead parrots. Could you have avoided that temptation?

Like Jon and Sam, a short while back, Scott, as our new Cloud Platform Engineer, is another very welcome and very welcomed additions to the CMS crew. And like them, one who is already delivering results for you, our customer.

Fleet operators have invested heavily in telematics over the last decade or more.

It has helped in many, many ways – route planning, logistics management, driver communications, reduced fuel usage, improved productivity, better maintenance, etc.

But with it has come the problem of too much telematics data. The “I can’t see the wood for the trees” situation, or “information overload” has happened in many situations.

This is compromising fleet risk management and driver safety.

Here’s how that problem can be sorted, by thinking differently.

The fleet industry has become abundant with telematics data and technology. Helping fleet managers with their tasks, and importantly, improving fleet risk management, over what went before.

From black box telematics, to forward facing dashcams, to complete video footage from around the vehicle, to online driver training, to license check systems and beyond.

Fleet operators can have it all.

Add into this mix, the fact that larger fleet operators often have a number of different telematics solutions, camera systems and fleet management information providers.

These provide the same, or similar, telematics data but in different formats and with differing interpretations.

Meaning that each telematics supplier used, adds to the fleet management task. As having to log into and use separate systems is time consuming and not very efficient.

Plus, one system only provides a singular view of the risks within the fleet operations, at any one time.

Meaning that there is then a task of aggregating telematics data into a reporting structure, commonly an Excel spreadsheet.

Given all this, you can see how companies and organisations operating fleets, now face the problem of “what to do with all this telematics data?”

That is, how can they best manage, interpret, and implement practises based around this ocean of data?

Plus, crucially, how can they see the true level of fleet risk in their operations?

While the current situation is a challenge, it is only going to get even more data rich.

Some would say data crazy.

With ever more connected vehicles coming online, we’ll soon be seeing 25GB of data produced, each hour by each vehicle.

That’s the same amount of data in 6,000 music tracks or 10,000 emails

Every hour.

Given the legal limit for driving a van is 56 hours per week. That means one van could be generating 56 x 25 = 1,400GB (or 1.4 TB) of data a week.

That’s equal to streaming about 300 HD movies (or, a little under half of the Netflix UK catalogue).

Makes you think.

Of course, all this data is a great resource.

Businesses can look into each part individually to see how a specific risk aspect is performing.

Such as, if a company would like to see which of its drivers are speeding, they can look into their telematics data and check for speeding reports.

If they would like to see if their drivers stay focused while driving, and don’t get distracted or smoke in their vehicles, they can log in to their in-cab camera system and check footage.

Great and valuable insight.

But managing this telematics data interrogation or monitoring, across a fleet of several hundred or thousands of vehicles and drivers, becomes a mammoth task.

And that’s before we are getting the data equivalent of Netflix’s catalogue once a fortnight from each vehicle.

Faced with this information overload, of more data but not always more insight. Fleet Managers are often compromised in their role by the very systems that were designed to help them.

Focus can spiral down to one narrow area, like managing speeding.

This then misses out on the value of the rest of the data. Which if it could be tapped into, could be used to pro-actively manage the situation in all areas of fleet management, including fleet risk management and driver safety.

The answers are in the data. But the volume of data is making the answers too hard to find.

There is a more concerning side to this data overload, as raised in an article in Fleet World, a few years back.

Importantly it considered the legal situation of having the data, but not acting on it.

That is, if a company’s driver is involved in an incident, and it can be proved that it had data alerting it to the likelihood of that incident happening, but it took no action. Then the legal ramifications could be severe.

To quote from the article,

Doug Jenkins, in his role as manager, risk control – motor, at insurance firm AXA, has noted a trend of fleets not acting upon the data provided. He said: “It is like any information companies have on a driver; if they are aware that the driver…is consistently exceeding speed limits, then this information must be acted on. The same applies if they carry out a driver risk assessment and it comes back as a high risk – they must act on it.

“If a driver has an accident that attracts the police, or Health and Safety Executive (HSE), they can seize any information or data that is available for that driver. This can be written files, and data from a camera or telematics.

“You can imagine the scenario where a driver is involved in a serious accident and is charged with dangerous or reckless driving and the employer has data that shows they have been driving badly for a long time and the employer has done nothing with it – both would be facing serious consequences.”

While telematics data is valuable for driver safety and fleet risk management. In many ways it only shows part of the risk management picture.

A full risk management system would bring in other non-telematics data, like a driver’s training history (or lack of) speeding fines and notices of intended prosecutions, as well as HR related issues like time keeping or poor driving reports from members of the public.

Aggregating data like this with telematics data, would give a broader and more comprehensive view of the fleet’s risk profile and potential issues in driver safety.

Of course, adding in even more data sources for fleet risk management and driver safety, could be seen as throwing petrol on a fire. From an information overload point of view.

Meaning that, like the telematics data, the insight from the information also gets lost.

Compromising potential gains in fleet risk management.

So, what is the answer to this challenge of too much telematics data, a future where there will be exponentially more, and a good reason to also add in data from other sources?

Like many things in life, there are two answers – work smarter or think differently.

Working smarter has been well covered in a range of articles by the telematics providers and operators in the telematics data community.

One is here, another can be found here.

These talk about the symptoms of information overload and propose strategies on how to deal with them.

Useful, but reading them they come across as good management advice – set a goal, start small, get organised, etc – rather than anything genuinely specific to the telematics data overload situation.

If you start from the point of view that to be an efficient and safe fleet the key is to have the right information in the right format at the right time. Then the approach changes.

The thinking isn’t about managing the data, its about what data is key to my decision making and monitoring process?

This approach leads to the challenge being about collecting all your telematics data into one place. Benchmarking it and filtering out the information you don’t need.

That is aggregate the data, normalise it, standardise it, and filter it.

If you can do this and do the same for the HR and other driver data that the telematics data doesn’t give, then you have a very workable solution for fleet risk management and coping with the information overload.

Additionally, a great benefit about this thinking is that you do not need to go out and buy more telematics.

You can use what you’ve got. Just think differently about how it’s being used.

This different thinking about the challenges of too much telematics data and how to improve fleet risk management, is where CMS started.

Our view was that if a fleet or risk manager in a business was able to bring in all their existing telematics data. From their different systems, across their fleet and have all that data aggregated. Along with their vehicle camera system footage and other risk data from HR and training records.

Then there would be a step change in the way they could manage fleet risk and keep drivers safe.

From this thinking, we built a SaaS platform that aggregates the data, normalises it, standardises it, and filters the information to just the key pieces that the risk or fleet manager needs.

All without the need for new hardware

All with the capability to integrate with any existing (and future) hardware

And all with the capability to scale up as the amount of data increases.

With this telematics data aggregation specialism, our platform gives CMS’ customers the answers to these fundamental risk management questions:

Is the risk profile of my fleet improving or reducing?

What behaviours and what drivers are causing this change in the business?

What is happening in my business right now that I need to take immediate action on?

Additionally, they are able to drill down into this information to a depot or driver level, within a couple of clicks. Meaning that they can pro-actively target reviews, training, and other management tasks, based on the risk profile.

This moves risk management from being about generic management and reactive processes to highly targeted proactive ones.

Ones that spot the likelihood of specific incidents happening, enabling managers to address them before they happen

Too much telematics data is a problem. It masks clear insight and can handicap fleet risk management by losing the key information in the ocean of data.

Addressing this, for fleet risk management, is not to invest in more hardware. It’s also not to work smarter.

The solution is to think differently.

Collect all the telematics data and other data you are currently producing.

Aggregate that data, standardise it and display it in one simple view.

Get the right information at the right time.

The benefits of doing this are massive:

The list goes on.

If you are a fleet operator that has too much telematics data and would like to get more insight from it, then a chat with us would be a great place to start.

We have helped fleets and insurers manage their data in the most efficient ways possible.

By collecting their telematics data, camera footage and HR related data direct from all their sources, then aggregating it and standardising it and displaying it all in one system they have all seen a massive ROI in the first year.

If this sounds of interest please call us on +44 (0)345 241 9449, email us at info@18.133.239.125 or fill in the contact form here

The full press release, issued by Crawford & Company;

LONDON (19 May 2020) Broadspire® by Crawford Company and a leading third-party administrator (TPA) of workers’ compensation claims, liability claims, disability and leave management and medical management services, has announced a new partnership with risk and incident management software specialist, Collision Management Systems (CMS), to deliver Broadspire Risk Assist, a real time risk management and incident alert software solution designed to help fleet operators reduce incidents, improve driver safety and lower claims costs.

Broadspire Risk Assist is a key part of Broadspire’s suite of connected claims and risk management services.

The software solution collects, combines and analyses data from any existing hardware or data source in a business, including telematics, wearables, tachograph, dashcam, claims, HR, operational and speeding / parking ticket data.

Broadspire Risk Assist enables fleet operators to gain critical insights into their corporate risk profile and the behaviors driving risk across their business, as well as pinpointing those employees most likely to experience an incident.

Real time incident notifications also allow the fleet manager and Broadspire to respond immediately to a situation, ensuring employees are supported and costs mitigated as far as possible.

Customers have experienced a near average 20% reduction in claims frequency, as well as a £1,000 reduction in average claims severity, per every detected incident through the use of the product delivered by CMS that will form an integral part of Broadspire Risk Assist.

Commenting on the partnership, Kirsten Early, managing director, UK & Ireland, Broadspire, said: “Through our partnership with CMS, we will enable our fleet clients to access critical risk data to help reduce incidents and lower claims costs in line with our mission to restore and enhance lives, businesses and communities.

This forms part of our commitment to provide scalable, user-friendly, tech-based solutions that have a positive impact on claim frequency and severity, whilst simultaneously improving our client’s employee safety.”

Charles Smith, CEO, Collision Management Systems, added: “A growing challenge in our connected world is the efficient use of the increasing amount of data that is being generated, to manage risk effectively.

We are proud to be powering a solution that will transform the duty of care and risk management program for Broadspire’s client base of global, highly recognisable brands. We look forward to helping every business to be even better at making their working world safer.”

A full copy of the press release can be downloaded from the Crawford & Company website here

More information about the CMS platform powering Broadspire Risk Assist can be found here

And if you would like to organise a demonstration of the platform please contact us here.

We are looking for a Cloud Platform Test Engineer to join Collision Management Systems’ growing development team.

You will be responsible for all testing of CMS’ cloud platform.

That is, testing for errors, identifying root causes, and working with the wider development and service team to find solutions.

For this role, you will have experience in manual, regression, functional, web and cross browser testing.

Plus, have worked with tools such as Selenium Webdriver, xUnit, or Postman, to both streamline and automate testing processes for UIs and APIs.

From this base, as our Cloud Platform Test Engineer, you will work with the Head of Product and the development team to define our future testing infrastructure.

While also supporting and assisting colleagues in Operations and Sales with platform demonstrations.

As part of our forward-thinking dev team, you will collaborate in the Agile Sprint-Scrums, have worked with JIRA, and be able to balance self-management with working closely with the broader CMS team.

Above all though, you will relish the exposure and accountability that comes with working for a small, fast-growing, tech business.

If this sounds like you, we’d like to have a conversation.

Please contact us on 0345 241 9449 or send your CV via our Join Our Team Page

Let’s get the conversation started.

Founded in 2012, and based in Central Milton Keynes, Collision Management Systems is helping make the world a safer place.

We collect data from connected vehicles and other data sources, to power our risk management solutions for the fleet, insurance, technology, and mobility industries.

Backed by the BGF, the most active VC fund in the UK, our award-winning technology is used by leading brands, around the world.

We mentioned a few posts back that CMS was accepted on to the new Crown Commercial Services (CCS) telematics framework.

That is, CCS telematics framework RM6143, in partnership with NTT DATA UK.

It replaces CCS telematics framework RM3754.

Two Lots are included within the new framework.

Lot 1 covers the supply of vehicle telematics hardware, software and associated products.

This includes products such as cameras and tracking solutions for equipment fixed or stored within a vehicle.

Lot 2 is restricted to only ten suppliers, and CMS is listed as one of them, under NTT DATA UK Limited , our partner

“Suppliers on this Lot will provide a software platform designed to enable buyers to analyse data from multiple sources to support their fleet operation, optimise fleet whole life costs and undertake effective risk management activities.”

Expires: 23/04/2024

Well, the framework is now live, as of May 1 2020.

Meaning that public sector fleets can more easily and more simply access our telematics data aggregation and risk management platform.

This includes fleets such as central government as well as the wider public sector including local authorities, the NHS and the emergency services.

It does this by eliminating the need to go to tender.

CCS telematics framework RM6143, speeds up the procurement process. Thereby saving time and delivering the benefits of our telematics data aggregation and risk management platform, faster.

CMS’ all in one platform helps fleet managers. Both in the public and private sectors. Improve the safety of their drivers, through effective risk management insight.

It does this by aggregating and standardising their existing data feeds. That’s the telematics data aggregation side of our work.

Which means that, it provides the right information at the right time.

With this fleet managers can take fast decisive actions to reduce employee risk and deliver cost savings.

With no-need for any additional hardware. In a future proofed, hardware agnostic way.

The platform combines the operator’s existing telematics and in-vehicle camera feeds with non-vehicle driver data. To present a user-friendly risk management and real-time incident alert solution.

On a day to day basis, the platform alerts fleet managers, in real time, to the incidents that need their attention.

It does this by filtering out distractions from false positives, and eliminating the problem of too much data from telematics.

Over the short to medium term it allows fleet managers and those responsible for risk management in the organisation, to know in more detail, their driver’s risk profiles.

From this, they will also know the organisation’s overall vehicle operations risk profile.

And with this insight, they can manage the trends, to reduce fleet & driver risk in their organisation.

That is, it works to help stop incidents happening in the first place and to keep people safe.

Charles Smith, founder and CEO at CMS commented;

“We are thrilled that CMS has been awarded one of just ten places on the new Crown Commercial Services Vehicles telematics framework. In conjunction with our partner NTT DATA UK. Through this we can deliver risk management and safety solutions to any public sector body directly. Under a pre-approved contract and framework.”

We have helped fleets and insurers manage their data in the most efficient ways possible.

By collecting their existing telematics data, camera footage and HR related data, direct from all their sources. Then aggregating it, standardising it and displaying it all in one system.

They have all seen a massive ROI in the first year.

If this sounds of interest please call us on +44 (0)345 241 9449, email us at info@18.133.239.125 or fill in the contact form here

As our Cloud Platform Engineer you’ll be responsible for the planning, operation and deployment of applications on our cloud platform.

With a real passion for automation. Building self-service tools and configuration management. Your work will support and develop CMS’ market leading crash detection and driver risk behaviour system.

As part of a forward-thinking development team, you’ll collaborate in the Sprint-Scrums, Reviews and Retrospectives. While also being able to effectively and efficiently self-manage your specific responsibilities.

Above all, you’ll relish the exposure and accountability that you get working for a small, fast-growing, tech business.

If you have five plus years dev experience. Know Azure and AWS. Have experience of working in an Agile Scrum development process. Then, we’d like to have a conversation.

To find out more, please call 0345 241 9449 , or send your CV via our Join Our Team Page

Let’s get the conversation started.

Founded in 2012, and based in Central Milton Keynes. CMS collects data from connected vehicles and other data sources. To power risk management solutions for the fleet, insurance, technology and mobility industries. Backed by the BGF, the most active VC fund in the UK. Our award-winning technology is used by leading brands, around the world.

We are very pleased to announce the recent arrival of two new starters at Milton Keynes based and world leading fleet risk management and telematics data aggregation tech company.

Joining Collision Management Systems are Jon Abbott and Sam Jowsey.

Because of the lockdown not all of us have had the chance to physically meet them, but we’ve been assured by those that did the interviews they are both great guys.

Experience from MS Teams meetings and Thursday night virtual after work drinks, confirms this. Although we do have some concerns about the mascots Jon has in his home office. Flat Eric anyone?

Jon is our new Development Lead, which in common software parlance, is our Scrum Master. He’s charged with working with Colin Woolmer, our Head of Product, and our development team, to keep sprints moving, the team focussed, and supporting them by getting issues resolved and sorted. But, that said while we are still a small(ish) company, Jon will be wearing many hats, using his coding and development skills to help out as needed.

Sam, a Kiwi and therefore likely to take stick from our two Rugby lovers, Charles (England, and occasionally Ireland – which explains a lot) and Colin (Wales, there’s lovely), joins us as our Web Developer. He is working on evolving and customising our customer web portal.

Which is important work as this is where they get the good stuff – namely the alerts to incidents that they really need to look into, and the risk management profiling that we provide. It really is the area where the rubber hits the road for our customers, as the insight we deliver, via the portal, leads to cost savings and safer employees.

In these strange times, Sam had the experience of finishing working for his old company and starting work for Collision Management Systems without the need to leave his chair, room, or house. “Odd” was how he described it.

Jon has over fifteen years’ experience of delivering software solutions, ranging from construction consultancy to laboratory informatics (yep, I had to look that one up). Sam spent the last four years working in web development at a Web design agency.

Well, both are Rugby lovers (there’s a theme developing here…) and both enjoy endurance challenges. Jon in the form of mountain biking, having recently finished 4th in the Manx 100km Open. Sam, in raising his son over the last four years. From experience, any parent reading this will know who had it easier.

On top of that they both have a love of the finer things in life. For Jon that is cheese and real ale, and Sam, “hot chips”. I’m taking that as being spicy crisps, for our British readers.

All in all, both are very welcome and very welcomed additions to the CMS crew. Who, in the short time they’ve been here, have already delivered results for our customers.