Collision Management Systems (CMS) works with the fleet management profession. Supporting fleet managers in using our platform to make better use of their existing telematics data, and thereby be better at their job. But what do we mean by fleet management?

In its broadest sense, fleet management is the business function and process that is responsible for all elements of an organisation’s fleet of vehicles.

That is a cradle to grave responsibility. In that the function covers vehicle acquisition, life-time management while on fleet and the disposal or de-fleeting of the vehicles.

In most organisations it also covers to some degree, normally legal compliance, the drivers of those vehicles.

As such it extends from the maintenance and uptime of the vehicles, through to budget management and onto incident and risk management. Which is where CMS’ platform really helps out.

The role of the fleet manager is therefore a very complex one. They often deal with thousands of (literally) moving parts, with their fleet of vehicles. A roster of drivers, business objectives and an external environment of legislation & compliance that can change quite rapidly.

Within this the key drivers for a fleet manager are always going to be: efficiency, cost management, risk management, duty of care, and compliance.

Unsurprisingly with such a complex management task, fleet management is either a dedicated function or department, within a business. Or is outsourced to a specialist fleet management company.

In both cases it is normally supported by a fleet management system. Which is a combination of software for fleet management. Coupled to in vehicle hardware devices such as trackers, GPS, and telematics.

Taking the above a little further the role of a fleet manager is based on the fact that any organisation that uses cars, trucks, LCV’s, or HGV’s within its operations requires some form of professional fleet management.

Just think of managing your own household vehicles. Buying them, servicing, and maintaining, insurance and road tax, MOT’s, driving, repairs, and selling. Then multiple that by 250, 500 or several thousand times, and you have an idea of what’s needed.

Be that an organisation which has a fleet of cars for its salespeople. Or a supermarket chain with thousands of branded home delivery vehicles. Which on any one day may be driven by two or three separate drivers, the complexity is immense.

The fleet manager is responsible for keeping these vehicles all doing what the organisation needs them to do (get salespeople to client visits, deliver to customer’s houses, supply other businesses, provide transport for the Police service, etc). While also improving productivity, reducing costs, ensuring legal compliance & duty of care and reducing risk to both the drivers and the organisation as a whole.

Like most things in management, data is key to gaining the insight to act on. This can be for scheduling vehicle downtime for servicing through to the data areas that CMS is expert in. Namely risk profiling and risk management.

Our SaaS platform supports fleet managers by taking in the oceans of data they get from their existing and installed telematics systems and devices. Standardising, normalising, and filtering it to give them just the alert and risk information that they need to act on.

With some understanding of the complexity of the task a fleet manager faces, here are some of the core challenges fleet managers face.

The nature of much of fleet management is problem solving. When things do not go to plan, or the unexpected happens (e.g. a vehicle has an incident). Sorting these problems out can be a drain on time and focus. Taking the fleet manager into the minutiae of an issue when their time could be better spent on bigger, more value adding tasks.

Administration tasks associated with tracking all the information required for each vehicle and every driver is also a big drain on the time of fleet managers. That is traditional or legacy based paper or spreadsheet recording of the situation takes time away from doing what is needed to improve the situation.

Of course, the big step forward for fleet management in providing efficiency has been automation via fleet management software systems and the associated hardware of telematics, dashcams and other sensors.

With many tasks automated, time has been freed up and errors from manual inputting & poor reporting have been reduced, if not eliminated. Tasks such as managing operating and fuel expenses, service records and reminders, communicating with drivers on schedules and routes can all now be automated. Effectively automation has helped that constant management challenge of good communication and clear oversight of the task or responsibilities (in this case the vehicle fleet)

While the fleet financing cost is likely to be the single biggest cost in fleet management, the second cost will be fuel. Anything that a fleet manager can do to reduce fuel costs will help the organisation’s bottom line, and so an important part of the role is fuel cost management. Again, fleet management systems automation has been a great help here as it provides the data and insight to allow the fleet manager to take effective action.

That is, they can check driver behaviour to identify trends like hard acceleration, engine idling or other poor habits, that impact fuel consumption. With these identified they can talk to the responsible drivers and train them on better, fuel saving, habits.

Better more fuel-efficient route planning becomes possible, and as traffic patterns change, new routes can be found and highlighted to drivers as being more efficient routes to take.

A further area where the fleet manager can have a big impact on fuel costs is in the deals and discounts that can be secured from using a fuel card. These can be highly competitive, and shopping around for the best deal can deliver big savings over the contract period.

One other area of fuel cost management, and one that is becoming a serious consideration is the choice of fuel.

Diesel has always been the popular choice for its cost per mile benefit, but recent issues such as the Volkswagen scandal and the growing concern over the emissions from diesel vehicles, particularly in urban scenarios, are detracting from that benefit.

While petrol would once have been the default alternative, fleet managers can now look not too far into the future and see electric and hybrid options coming on stream. While these may have a higher unit cost, this will be heavily offset by the lower running costs.

Plus, their environmental benefits may become as big an influencer in an organisation’s policies as the reduced running costs are to the organisation’s fleet manager.

The fleet manager is responsible for determining what vehicles are needed on the fleet, both type and number. This runs from bringing them onto the fleet through to the de-fleeting and disposal.

To do this effectively the fleet manager needs to keep upto date on vehicle needs, the options and availability of vehicles from the manufacturers, changes to vehicle legislation, tax, and insurance, plus employee expectations about the type and quality of vehicles they will be driving.

Within this there is a constant need to look at the life-time cost of the vehicles on fleet – financing, operational and end of life – so that budgets can be met, and savings made. As an example, white vans hold a better value when being de-fleeted over more niche coloured vans.

Ontime and regular servicing and maintenance of the vehicle fleet is crucial to the fleet’s operations and minimising vehicle off road time. Again, this can be a complex task given the size of fleets that many fleet managers manage.

Tracking all the information to support this can be a major time sink – vehicle mileage needs to be recorded, servicing planned and actioned etc – so, most fleet managers use a fleet management software system to keep on track of the situation. These take live feeds from the vehicle telematics systems and track that information against the service scheduling to provide ongoing scheduling and prioritisation of service bookings.

There are also disciplines for the drivers to maintain, such as daily visual checks of vehicles, which the fleet manager can lead and enforce within the drivers. This means that not only are the drivers taking responsibility for the vehicle’s that they are driving but the fleet managers get notified of any issues that can require maintenance or repairs.

Being able to communicate with drivers is a crucial part of the fleet manager’s responsibilities and can be challenging as the drivers are out on the road.

Regular pre-shift briefings by team leaders, email and other communication channels are good for a daily update, but on-the-road communications can still be a challenge.

Mobile and cell phones have made a huge difference in this area, and so have telematics systems. These enable fleet managers to check on the location and timings of their drivers, plus communicate with them when schedules and plans change. Similarly, drivers have the capability to contact the fleet manager when the unexpected happens.

While this is still a challenge for the fleet manager, the use of the modern fleet management systems has improved the capability immensely in the last decade, making dynamic communication and therefore more flexible and agile fleet operations possible.

One of the most important areas of responsibility for the fleet manager is the health and safety of the drivers and the duty of care to those drivers that the company extends.

Incidents happen, and the fleet manager needs to be able to know they have happened, and to take fast, responsive, and effective action to help the driver and any other party involved. This includes following first notification of loss (FNOL) procedures for insurance reporting and repair management.

Good communication standards between the drivers and fleet managers can help in these situations. To support this effective fleet managers will build strong working relationships with their drivers, as like in most situations, a strong worker-manager relationship can go a long way in getting things done effectively.

They can also be helped by the use of telematics which will alert the fleet manager to incidents that have happened so that they can proactively contact the driver to discuss the situation with them.

CMS’ platform helps in this regard as it works to filter out the false positives that can be reported as incidents (e.g. a driver going over a pot hole fast can be reported as a collision), giving the fleet manager alerts to only the incidents they need to react to.

Further, by incorporating non-vehicle driver data such as training records, annual reviews, traffic violations, etc, our platform gives the fleet manager a 360-degree view of the driver’s risk profile.

This allows them to identify the drivers more likely to have an incident (be it their driving behaviour, the routes they work, the vehicle they drive, or a combination), and focus their management time on those drivers rather than having a blanket training and review process.

Ultimately, by using CMS’ platform, the fleet manager is working to avoid the incident happening in the first place. Which is an ultimate expression of an organisation’s duty of care to its drivers.

Legal compliance is an essential part of the fleet manager’s role and supports the duty of care aspect as well as the fleet’s operations.

It includes areas such as vehicle checks, inspection sheets, driver checks, maintenance reporting, damage management, MOT’s, insurance, road tax, emissions, etc.

It is also an evolving subject as both local and nationwide changes happen, for example the Direct Vision Standard due to come into force in London in Autumn 2020 (UPDATE: now February2021). So, fleet managers have to stay on top of the changes as well as manage the existing information, conformities, and non-conformities.

Ultimately, this ensures that a full audit trail of information is compiled for each vehicle and driver for both management purposes and in case the organisation needs to provide information due to an accident, a claim, or an investigation.

Given all the above, an additional challenge in fleet management is avoiding information overload.

The quote, keeping the main thing, the main thing, is the main thing, is a management mantra that many fleet managers must adhere to.

They have access to huge amounts of data from a long list of sources covering a wide range of subjects. It is very easy to lose time and focus in this complex matrix of information. This can run the risk of missing the key and important points, which can have cost implications.

Fleet management systems automate a lot of this information gathering and reporting making the fleet managers life somewhat simpler.

In the case of incident alerts and risk profiling, CMS’ platform take this further by bringing in all the information from existing and installed telematics devices, standardising and normalising the data, and filtering out the false positives.

This leaves the fleet manager with just the information they need and notifications to the alerts that need their attention.

Like all jobs and professions fleet management is facing a huge set of changes as technology and other factors change.

Technology in the form of telematics, GPS, fleet management systems, mobile phones, and Collision Management Systems own software, have fundamentally shifted the fleet managers role into being a more dynamic, better planned and more responsive role.

It has also added in more complexity as the sheer amount of data that is available as management information has grown.

There is more insight available, but knowing what insight is valuable has now become a key skill.

This need will be a key area to be addressed in the near future. It is what CMS exists to-do right now in the areas of incident alerts and risk management – take in disparate and multiple data sources, use technology to check and filter that data and give the fleet managers just the insight that they need to manage.

The other areas where fleet managers are going to have to evolve their skills and knowledge are in ACES vehicles and environmental impact.

ACES – Autonomous, Connected, Electric and Shared – vehicles are the future. Driverless vehicles, using electric power and shared across several fleets all connected via the internet are less than a decade or two, away.

Technically possible now, the evolution to let them happen has to be in legislation, to allow driverless vehicles on the roads, the socio-economic area of no longer needing a profession of commercial drivers, and the infrastructure to support electric charging on an industrial scale.

Environmentally fleets will change as organisations move from diesel and petrol fleets to electric, or other more sustainable energy, fleets. This will be driven by strategies that fleet managers need to influence but will also be impacted by.

What these two areas mean for fleet management is that it will go through another period of transition where the old established ways will be taken over by new better ways.

These will deliver new cost savings and more efficiency, just as telematics, GPS and fleet management systems have over the last two decades.

The skill of the fleet manager will be in getting the pace and depth of implementing these changes right.

The starting point for CMS’ work is that the growth in the disparate data sources used by fleet managers (telematics devices, connected in vehicle cameras, and other connected vehicle technologies) is adding to the management challenge as the amount of data generated drowns out the value of the clear insight it is designed to deliver.

CMS’ connected-data SaaS platform, aggregates the data, references, standardises and normalises it, no matter the source(s), providing clear actionable information, insight and alerts.

It does this in a technology agnostic way, allowing users to aggregate and process data from any of their existing or future connected sources.

This includes connected cameras, mobile apps, telematics, black boxes, video data, employee information, training records, traffic offences, etc.

Once aggregated, proprietary methods standardise and normalise the disparate sources, so that all data is both comparable and consistent in the moment and over time.

With this methodology, time critical incident alerts are notified in real time, without needing to sift through the mass of data noise.

Additionally, and importantly, users are able to access a simple, single view of their fleet, driver, and remote worker risk profiles and behaviours.

In terms of results, CMS’ platform has delivered a 400% ROI and a close to 20% reduction in near miss and collision frequencies.

It also allows fleet operators to answer these four principal questions:

How is my organisation’s risk profile changing?

What behaviours are causing this change?

Which employees or drivers are the biggest contributors to my risk profile?

What incidents are occurring right now that need a response?

through assessing not only the on-road risk, but all occupational road-risk contributing factors, by incorporating corporate, employee, legal, and other related data into their risk management programme.

severity and total claims spend by enabling incidents to be responded to faster and with more data.

by identifying drivers who are at a higher risk of an incident occurring.

by better targeting of management and training resources to risk-profiled drivers.

in place to support company and brand reputation.

In partnership with Collision Management Systems, NTT DATA UK, recently announced, its acceptance onto the new Crown Commercial Service framework for Vehicle Telematics

This comes into use near the end of April 2020.

The news means that UK Public Sector fleet operators, such as the Police, and other emergency services. Plus, UK central and local government bodies.

All now have easy access to CMS’ award-winning telematics data aggregation and risk management platform.

This will improve the procurement process, for those organisations using the Crown Commercial Service framework, by eliminating the need for tender.

Thereby saving them time and delivering the results from our platform, for risk management, faster.

NTT DATA, a leading CMS partner since 2019, is a trusted multinational technology innovator.

Its services range from consulting and systems development to outsourcing.

NTT DATA serves a broad range of sectors, including telco, media, financial services, manufacturing and the public sector.

CMS’ all in one platform helps fleet managers improve the safety and efficiency of their fleet and remote worker operations.

Aggregating and standardising the existing data feeds. It provides the right information at the right time for fleet and transport managers to take fast decisive actions that reduce employee risk and deliver cost savings.

With no-need for any additional hardware. And in a future proofed, hardware agnostic way.

Our platform combines and aggregates the fleet operator’s existing telematics and in-vehicle camera feeds. To present a user-friendly risk management and real-time incident alert solution.

This is used on a day to day basis by fleet managers and transport managers to identify the incidents that need their attention. While filtering out distractions from telematics’ false positives.

Over the short to medium term it allows both the fleet managers and those responsible for risk management in the organisation, to know in more detail their driver’s risk profiles, the organisation’s overall vehicle operations risk profile and with this manage the trends in these, to reduce risk in the organisation.

We term it as knowing and managing the 20% to get the 80% improvement.

Our telematics data aggregation and risk management platform is already operational in various global organisations.

It has delivered a near 20% reduction in incidents.

Savings of over £1,000 on vehicle claim costs.

Dramatically reduced vehicle off road times and sped up first notification of insurance claim processes (FNOL).

Data security and compliance are built into the heart of the platform. For both employee and the organisation’s peace of mind.

CMS’ platform combined with NTT DATA UK’s market resourcing and systems integration expertise, make these benefits immediately available to public sector fleet operators across the UK.

Here at Collision Management Systems (CMS) we talk a lot about telematics, telematics data and how organisations can make better use of the data they are already getting from their existing telematics systems.

The word telematics is an Americanisation of the French wort télématique.

It describes the technology that transmits information from multiple remote sources, such as vehicles, off site plant & machinery and individuals. To a central point for management information purposes.

As such telematics technology is used in a wide range of industries, and is commonly associated with and used in the transport and insurance industries.

But, as a reliable and commonly useable technology, Telematics really took off with the rise of the internet, and the capability of cellular and mobile networks to transfer lots of data, from lots of sources, in real time.

Once sent, this data is stored in servers that are accessed for tracking, reporting, analysis and insight via the internet.

A leading use of this capability is fleet management, allowing users to monitor individual vehicles up to an entire fleet.

Telematics systems in the vehicles gather data including vehicle activity & location, driver behaviour, and engine performance, presenting this information to help fleet managers do their job more effectively and efficiently.

Through adopting telematics for their fleets, many organisations have improved their reliability, boosted customer service standards, increased efficiency and through this delivered savings to their bottom line.

By using existing telematics data, we evolve the capability of fleet managers, operators and insurers to better manage the insight they get from their telematics and take control of the broader tasks of fleet and driver risk management.

Modern telematics systems gather a huge amount of data from GPS, in vehicle sensors and vehicle engine data. This is combined to provide fleet managers with information to manage their fleet.

GPS provides real time information about the vehicle’s location, its speed, including being stationary, and from these, movement over time.

Vehicle sensors capture data on how the driver is driving and other information about the vehicle. This includes fast acceleration, harsh braking and hard cornering.

Also, the sensors can monitor other in-vehicle activity such as when doors are opened, vehicle internal temperatures (e.g. for refrigerated vans) and impacts, be they hitting a pothole through to actual collisions.

Engine performance information pulls data directly from the vehicle’s diagnostics system. This gathers live data on fuel efficiency, mileage, engine temperature, idling, malfunction, etc. Information that is then used to plan scheduled maintenance and highlight issues outside of these schedules.

All this data is gathered into the onboard telematics device in each vehicle and transmitted over mobile phone networks to a central data hub.

From there the information is provided to fleet managers via software that helps them visualise, plan and optimise their operations.

As you can imagine this is a huge amount of data and is growing over time as more sensors are added to vehicles.

This data ocean is causing issues in itself in that there is too much data, too much noise, and the key information and insight is often drowned out.

Taking in disparate data sources from multiple systems and different vendors, CMS aggregates the data, standardises and normalises the telematics data, removing the irrelevant false positives, to provide just the information the fleet managers need on the incidents they need to react to.

The old adage, if you can measure then you can manage, is what telematics is all about.

Fleet managers using telematics-based fleet management systems can manage fleets of all sizes and gain valuable savings and improvements.

The main benefits are built around more efficient route planning and delivery scheduling, and expand out from there:

Fuel is probably the single biggest cost facing fleets managers. Being able to identify and reduce wasteful fuel use is a big step forward in overall cost efficiency. Telematics supports this through better route planning, reducing miles driven, reducing delivery wait times and cutting engine idling by avoiding traffic problems.

With telematics fleet managers are warned about mechanical issues in their vehicles, allowing them to address the problems sooner and thereby reduce the danger of major issues while keeping vehicle off the road time down to a minimum. Scheduled maintenance is also simpler to arrange and plan as it’s based on live mileage data, which again helps minimise vehicle off the road time.

Before telematics keeping in touch and upto date with drivers was a hit and miss affair. Telematics has simplified this by automating the updating of location, timings, etc reducing the need for fleet managers and drivers to check in and report back. As well as ensuring that managers have access to the data they need faster, this allows both drivers and managers to spend more time concentrating directly on the job in hand.

Co-ordinators can make constant route adjustments, responding to traffic, vehicle’s available and even weather, by knowing the location of every vehicle in the fleet at any time. Resources can be switched around to ensure deliveries and collections happen when customers need them. Additionally, they can keep clients informed of the situation, which increases customer satisfaction.

Regulatory compliance and the related administration is greatly simplified through telematics using digital tachograph data.

A crucial consideration for organisations operating fleets of vehicles is driver safety. Telematics can improve driver safety by monitoring both driver behaviour and vehicle performance. Unsafe driving, incidents and collisions can be detected and addressed quicker.

This last point, driver safety, is where CMS very much comes into play. Our technology aggregates the driver and vehicle data, eliminates the many false positives that can plague telematics (e.g. alerting a collision when in fact the driver has hit a pot hole), and provides clear and simple alerts to the incidents that really matter and fleet managers should act on.

Further, we can combine this information with other organisational information about the driver (HR & training records, driving violations etc) to produce a 360-degree view of the driver’s risk profile. With this fleet managers can focus their attention on those drivers who are a greater risk, helping them to reduce that risk with training and reviews. That is, they can manage the 20% of drivers which cause 80% of the issues and thereby be more efficient in the use of their time and other resources.

Telematics and the data associated with it have made great improvements in the profession of fleet management. However, it has brought issues with it as well.

An article in Fleetworld highlighted that the amount of data being created by telematics was leading to data overwhelm or analysis paralysis for many fleet managers. A potential issue of this, with major consequences, could be a driver incident leading to a criminal prosecution. If the telematics data showed that the driver had a history of risky driving and that the organisation had not acted on it, then the legal ramifications could be far reaching.

While telematics uses many sensors to gather information, these sensors can often record an incident incorrectly due to calibration or sensitivity settings. For example, a hard slam of a boot lid can be in recorded as a rear end impact on the vehicle. These false positives are fed through to the fleet managers and are either reacted to, diverting time to checking out something that is false, or after a while of investigating these sort of things, simply ignored. Meaning that when a real incident happens that needs attention, the fleet managers are in a cycle where they doubt the information and ignore it.

While telematics provides all the in-vehicle data and insight that the fleet manager and operator can use (and in many cases too much data), it does not have the out of vehicle data on the driver.

Such as their training records, last management review, driving and traffic violations, etc.

Without this other half of the data, the full 360-degree picture of the driver’s risk profile is missing.

Meaning that management resources may not be targeted as precisely as possible, leading to a blanket rather than individualised training cycle and risks being missed.

So, while telematics and the data provided have made a huge difference in fleet management capabilities, it hasn’t come without complications.

The starting point for CMS’ work is that the growth in disparate data sources from telematics devices, connected in vehicle cameras, and other connected vehicle technologies is adding to the management challenge. As the amount of data generated drowns out the value of the clear insight it is designed to deliver.

CMS’ connected-data SaaS platform, aggregates the data, references, standardises and normalises it.

No matter the source(s), providing clear actionable information, insight and alerts.

It does this in a technology agnostic way, allowing users to aggregate and process data from any of their existing or future connected sources.

This includes connected cameras, mobile apps, telematics black boxes, video data, employee information, training records, traffic offences, etc.

Once aggregated, proprietary methods standardise and normalise the disparate sources. So that all data is both comparable and consistent in the moment and over time.

With this methodology, time critical incident alerts are notified in real time, without needing to sift through the mass of data noise.

Additionally, and importantly, users are able to access a simple, single view of their fleet, driver, and remote worker risk profiles and behaviours.

In terms of results, CMS’ platform has delivered a 400% ROI and a close to 20% reduction in near miss and collision frequencies.

It also allows fleet operators to answer these four principal questions:

How is my organisation’s risk profile changing?

What behaviours are causing this change?

Which employees or drivers are the biggest contributors to my risk profile?

What incidents are occurring right now that need a response?

With this fleet operators are able to:

through assessing not only the on-road risk, but all occupational road-risk contributing factors, by incorporating corporate, employee, legal, and other related data into your risk management programme.

by enabling incidents to be responded to faster and with more data.

by identifying drivers who are at a higher risk of an incident occurring.

by better targeting of management and training resources to risk-profiled drivers.

in place to support company and brand reputation.

A new international and UN/WHO supported report into work related road injury, stresses the urgent need to address fleet safety.

Co-author of the report, Mary Williams OBE, chief executive of Brake, said: “This vital report is the first international report of its kind uniting voices in proclaiming the urgent need to address deaths and injuries on roads caused by a vehicle being driven for work purposes”

The report, “Managing work related road injury risk”, can be accessed on the Brake site.

It focusses on road risk management needs and recommends governments strengthen legislation. And fleet operators implement procedures. To better manage road related risk. Including improvements in data collection regarding work related road injury, collisions and their causes.

The report is prefaced by, Etienne Krug. Director at the World Health Organisation, who hopes the “report will play a valuable contribution to strengthen action on work-related road safety.” He “urges governments and organisations to read it and implement urgent actions to save lives.”

The report leads with a sobering fact: “In most high-income countries, an estimated one-third of road traffic crashes involve someone at work. In developing countries, it is likely to be higher.”

It covers how the issue should be addressed. Within the UN 2030 Agenda for Sustainable Development, and via public-private partnerships across societies.

The report also details a history of success stories in work-related road injury risk (WRRR). From around the world and over the last 15 to 20 years.

In so doing it highlights that “Good management of those who drive for work and ensuring decent work conditions has been shown to reduce risks and improve business outcomes.”

As an observation, from the customers that CMS works with. These strategies of good management and risk considerations are core to their fleet and driver risk management programmes.

We’ve also found that with the combination of customers prioritising risk management, and our technology. They are moving from using descriptive information (what has happened?) through predictive (what’s likely to happen?) and onto prescriptive strategies (what should we do?).

That is, for many of our customers it is no longer about knowing what has just happened.

It’s not even about predicting what will happen.

It is now about informing how to stop it happening.

And as the “Managing work related road injury risk” report implies, having good, clean, actionable data is THE key part to this evolution.

So, like much in life, an old maxim still holds true. In the case of road, fleet and driver risk management it is “if you can measure, then you can manage”.

Good to see the return of the Van Driver of the Year competition, from the FTA (recently rebranded to Logistics UK)

Looking to recognise the UK’s very best van drivers.

Now in its seventh year, the competition was launched at the start of March. With entries being accepted from March 16.

Twenty finalists will compete through a series of tasks on Saturday June 13 at Ashby-de-la-Zouch (postponed to 21 November due to COVID)

While some will make sad jokes about such awards, they miss the value they bring to professions and business communities.

In this case one which is:

(a) vital to the way we now live

(b) working to raise standards for all of our benefit.

The three areas of the award – safety, efficiency and compliance – all work to foster a mature and professional approach to driving and customer service. In what are predominately crowded urban driving environments.

This is important now and will only become more so as our lifestyles shift more and more to online shopping.

With its associated need for organisations to give focus to the management of the last mile and multiple small deliveries. Skilled, risk aware and risk managed van driving, as a business practice must become the norm.

Kevin Green, Director at FTA, put it like this:

“Van drivers are required to be safe, efficient and compliant.

The growth of vans for varied trade use such as plumbing or floristry, together with the rise of internet shopping, has resulted in van drivers playing an increasing role in the UK economy.

FTA looks forward to recognising and rewarding these outstanding individuals who can demonstrate excellent manoeuvring, observation and concentration skills, as well as their ability to work safely and efficiently in line with best practice.”

At CMS we can only agree with the goals of the Van Driver of the Year competition.

Through our work in helping leading organisations identify and reduce their risk in running van fleets, both in the UK and abroad. We are only too aware of the challenges drivers and organisations face each and every day.

Route planning, crowded delivery schedules, traffic problems, wrong paperwork etc all combine to add to the risk factors faced by van drivers.

Anything that can be done to alleviate that risk, be it the software based risk management solution that CMS offers, or improvement in the standard of van driving by creating focus points such as the Van Driver of the Year competition, can only be good.

Given what we work on, the problems we help organisations solve and the incidents we see van drivers dealing with. All of us at CMS welcome the FTA’s work in this area, and the expression of this with the 2020 Van Driver of the Year competition.

After all, it can only help to, as we say, manage risk better, make the working world safer.

As we said goodbye to 2019 Collision Management Systems achieved two key milestones.

The first was passing one hundred thousand connections to our award-winning connected vehicle data aggregation SaaS platform.

The second, through our network of global telematics vendors, CMS can now access over half of all the commercial vehicles in the UK and Americas, that have telematics installed (subject to the consent of the customer, of course).

The growth in data sources from commercial connected vehicle technologies, while providing more information than ever before, is adding to fleet management problems.

As the sheer amount of data drowns out the value of the clear insight it is designed to deliver.

Telematics and other connected vehicle technology data is creating a form of analysis paralysis in many fleet management teams that use it.

Leading to the full potential value that it can deliver, not being realised.

CMS’ success has been in providing an answer to this situation.

Our SaaS platform, aggregates data from a huge and growing range of connected vehicle and telematics devices.

References, standardises and normalises it, to provide clear actionable information, insight and alerts.

For those customers who manage the more than one hundred thousand connections to Collision Management Systems platform, this has been a step change in how they are alerted to, informed about and manage their fleets of connected vehicles.

While the improved management of the connected vehicle data is important for fleet management efficiency, that isn’t where the value that CMS adds, ends.

At its heart, Collision Management Systems is a data aggregation company. Able to take data from a huge range of sources, combine it and provide benchmarked insight.

This means data from sources other than the connected vehicle fleet can be combined with the standardised and normalised data from the connected vehicle fleet.

Giving a full 360 degree view of drivers, remote workers, their teams, their divisions, and the whole organisation’s drivers and remote workers.

For example, training records, annual performance reviews, driving offences (e.g. parking and speeding tickets), can be combined with the drivers on-road, in the connected vehicle, data to give the full 360-degree view.

With this information and insight, Collision Management Systems is giving customers the power to transform their duty of care and risk management programmes for drivers & remote workers, and with this better manage their overall risk profile.

With this insight (literally) at their fingertips, CMS’ customers, such as Fleet Managers, are able to readily answer and manage these four key questions.

How is my organisation’s risk profile changing?

What behaviours are causing this change?

Which employees or drivers are the biggest contributors to my risk profile?

What incidents are occurring right now that need a response?

With these answers they have actionable insight for their fleet risk management programmes, and the associated brand/company reputation guardianship.

Plus, they have seen improvements in their fleet management efficiency and importantly the associated costs from better management of FNOL (First Notification of Loss) and VOR (Vehicle Off Road).

While understandable commercial confidences prevent us from naming the customers which make up the one hundred thousand connections, this anonymised real-life account captures the benefits one of them has realised.

An organisation with increasing operational and insurance costs, worked with Collision Management Systems to address its connected vehicle technology issues and improve its overall fleet risk management programme.

The organisation had many siloed data sources. A highly visible brand to protect. Pressure from rapid expansion, and was struggling with a lack of scalable risk and data management processes.

CMS’ solution delivered a combined and structured data set using more than ten complex data sources (e.g. telematics, other connected vehicle technologies, non-vehicle and other data). Covering fifty classes of data. A user interface to deliver the data that integrated with the organisation’s risk management processes. And a capability to view in one place all time critical fleet, driver risk and vehicle incidents, in real time.

Benefits from this engagement were identified just twelve weeks after the project’s inception. They have continued to grow over time, and the project is now credited with a 400% ROI. Based on better safety & driver risk management, a 40% increase in driver training productivity. A 17% reduction in near miss and collision frequency, and an average £1,000 reduction in incident costs.

Our CEO, Charles Smith, said after we passed the one hundred thousand connections milestone, in 2019,

“The last eighteen months have been fantastic for CMS.

Building on our existing momentum and investing in our software, services and people to deliver accurate data and stand-out customer service to our growing client base”.

“We’re delighted to have comfortably passed the significant milestone of 100,000 connected vehicles. And integrations completed with over 50 telematics brands.

All of which is testament to the hard work of a great team.

On the current trajectory, we should pass 250,000 connections before the end of the year (2020)”.

Please call us on +44 (0345) 241 9449, email us at info@18.133.239.125 or fill in the contact form at the bottom of our homepage.

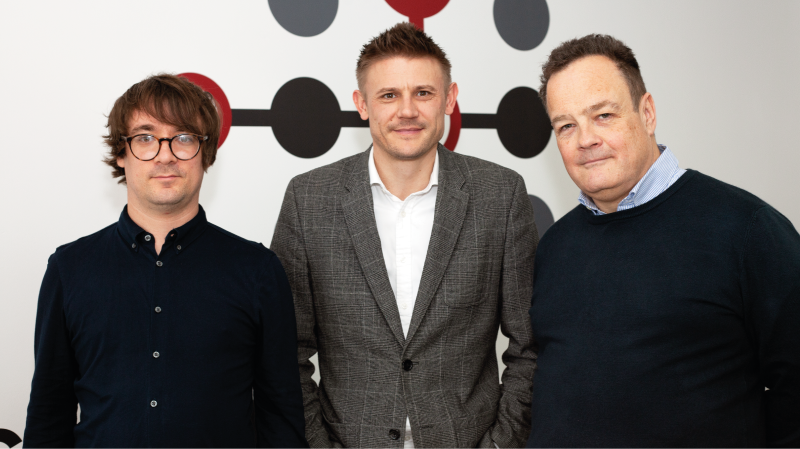

Milton Keynes, UK, 25 February 2020 – Collision Management Systems (CMS), the connected vehicle data specialist.

Working with insurers, fleets and remote worker organisations to reduce employee risk.

Announced the appointments of Jonathan Wool and Aaron James as Business Development Managers and Frank Reynolds as Head of Marketing.

These appointments further expand the burgeoning CMS team as it grows to meet the demand for its SaaS based risk management and cost saving solutions for the connected commercial vehicle and remote worker sectors.

Joining the company at the start of February Jonathan Wool leads the sales team at CMS with responsibility for developing customers in the fleet and insurance markets.

Prior to CMS Wool worked for VUE Group with a focus on fleet risk management.

This built on his financial services background, in fleet insurance, both underwriting and broking and his launching of PAYG fleet insurance products in the self-drive hire insurance sector.

On starting his role at CMS Wool said “It’s great to be part of CMS, bringing customers a market leading technology that is changing the way fleets and connected data driven businesses assess, manage and action risk.”

Aaron James joined the company in mid-December to lead the development of CMS’ customer, prospect and market insight platforms.

Working in partnership with Wool, he now leverages that insight to develop opportunities for CMS’ risk management SaaS offering.

Before joining CMS James worked on leading car manufacturer accounts at a marketing agency and in business development roles at Suzuki.

“I’m thrilled to work for such a fast-growing company with innovation at the heart of everything it does. CMS has so much to offer in the field of connected data management to help customers manage their risk better”,said James.

Completing this expansion, Frank Reynolds joins from a simulation and VR specialist, having previously worked at Europcar and Hertz.

Reynolds’ remit is to expand the footprint of CMS’ marketing, with focus on digital aspects, as the company expands both domestically and internationally.

Commenting on this Reynolds said “CMS provides a revolutionary solution for connected data management and its application in risk management. It is very exciting to be taking that capability to a global marketplace.”

Charles Smith, CEO at CMS commenting on these appointments said, “With this expansion to our commercial team, CMS is even better placed to deliver solutions for employee and driver risk management to large fleets, commercial insurers and technology partners.”

He added “At the end of 2019 we passed 100,000 connections to our platform, with this expanded team, we will quickly power past 250,000 connections as we help more organisations around the world manage incidents and risk better and make the working world safer.”

Collision Management Systems (CMS), the connected vehicle data specialist, working with insurers, fleets and remote worker organisations to reduce employee risk, announces a second round of funding from BGF, the UK and Ireland’s most active investor in growing businesses, to further accelerate its growth.

This investment comes as CMS passes the milestone of over 100,000 connections to its award-winning platform.

In addition, through the integrations CMS has in place with multiple global telematics vendors, the company can access over 50% of commercial vehicles with telematics installed; subject to consent of the customer.

Founded by CEO Charles Smith, CMS has taken a market lead in using the growing volume of telematics data to manage risk better and respond to incidents faster.

Using its proprietary platform to take in, refine and analyse data from any connected vehicle, company or person, CMS’s technology delivers solutions that answer four principal questions:

How is my organisation’s risk profile changing?

What behaviours are causing this change?

Which employees or drivers are the biggest contributors to my risk profile?

What incidents are occurring right now that need a response?

BGF first invested in CMS in July 2018 to accelerate its market expansion and secure multiple licensing deals with insurers, fleets and global resellers, as well as hire critical product and commercial staff.

Since then, the business has more than doubled its staff and tripled its customer base.

The company has also established a strong International footprint with new customers in Europe, South America and the United States.

This follow-on funding is part of a long-term investment strategy with BGF and will support further investment into CMS’ sales, delivery and engineering teams focussed on the UK and abroad.

Charles Smith, CMS CEO said: “The last eighteen months have been fantastic for CMS, building on our existing momentum and investing in our software, services and people to deliver accurate data and stand-out customer service to our growing client base.

“We’re delighted to have comfortably passed the significant milestone of 100,000 connected vehicles and integrations completed with over 50 telematics brands, which is testament to the hard work of a great team.

With the continued funding and support of BGF and our shareholders, we’re looking forward to expanding our operations further, taking advantage of a thriving market both in the UK and internationally.

On the current trajectory, we should pass 250,000 connections before the end of the year.”

James Syrotiuk, an investor at BGF who sits on the CMS board, commented: “Charles and the CMS team have developed a fantastic reputation and track record in the market in a short space of time, powered by unique and cutting-edge technology delivering significant benefits to customers.

We are proud to be CMS’s long-term investment partner and are looking forward to supporting the business as it enters its next stage of growth.”

The advisors to the transaction were:

CMS: Blaser Mills (Legal)

BGF: Freeths (Legal)

CMS founder and CEO, Charles Smith, was an undergraduate when he had an idea that would see him start a multi-million-pound business working in the emerging field of connected vehicle data.

“I was researching vehicle collisions for my materials engineering course,” Charles explains.

“It became apparent that telematics providers didn’t know the details about the data that Insurers really needed – and equally Insurers weren’t clear on what data was available from connected vehicles.”

Charles’ idea was to aggregate data from the growing number of connected vehicles and help fleet, logistics and insurance companies in the risk management of their remote workers, drivers, and clients.

By bringing together this complex multi-source data, CMS’ customers can identify incidents that need their immediate response.

And beyond that, determine employees who are higher risk, and in need of management and training focus.

To better manage the organisations overall risk profile.

On Christmas Eve 2016, CMS landed its first major client.

Global insurer Swiss Re, which realised the tangible benefits of CMS’ connected vehicle data offering for both cost management and customer service.

Two months later, Tesco, the leading UK retailer, followed.

With a programme to use the connected vehicle data coupled to other inhouse data to better manage employee risk.

When talking about these early days of CMS, Charles comments:

“We went from real start-up bootstrapping to delivering our software on a global scale.”

CMS’ rapid growth in the field of connected vehicle data brought a set of challenges common to many successful start-ups.

As Charles remembers:

“We were swinging between delivery and sales. It became clear that we didn’t have the bandwidth to do both properly.”

CMS started with private investor funding, which saw its initial product development and market success.

But if this specialism in connected vehicle data and the benefits it brought to client’s risk management activities was to go further, additional investment for growth was needed.

In July 2018, BGF, a leading UK based investment partner with a portfolio of £2bn, invested £1.25m to support CMS’ growth plans.

Charles chose BGF because of its:

“refreshingly different” approach. “BGF lets you get on with running your business,” he explains.

“BGF really bought into our journey – and we liked the fact that we could have a proper conversation with someone who wanted to go on that journey with us.”

BGF also introduced CMS to non-executive director (now non-executive Chairman) Stephen Lake.

“You only grow a business on people and Stephen has helped us understand how to build a really effective team in a fast growth environment,” says Charles.

With this investment, CMS quickly made a range of new full-time hires, enabling it to continue to grow, adding customers and partners, and becoming a recognised global leader in connected vehicle data management.

The business now works with a host of household names around the world, including Eddie Stobart, Whirlpool, National Interstate Insurance, Zurich and Pioneer.

The foreseeable future sees CMS continue to rapidly grow, adding customers and partners in the US, as well as in the UK and other parts of the world.

As its expertise in connected vehicle data management and how that data can be better used to support organisations risk management programmes, becomes more widely known, this pace of growth is set to continue, if not increase.

Adapted from an article originally appearing in BGF’s “Ready for Business – A Year in Review”, published in Autumn 2019

For the first time, CMS will be exhibiting with its own stand at the Commercial Vehicle Show, at the NEC, Birmingham, April 28-30, 2020

The Commercial Vehicle Show 2020, or more simply, the CV Show, is unquestionably the main event for all UK road transport related industries, in Britain.

It attracts more than 19,000 visitors and has over 400 leading suppliers across the whole spectrum of commercial vehicle operations such as; truck, van and trailer manufacturers, fleet, finance and leasing companies, tyre manufacturers, insurance companies and telematics & training providers.

The CV Show is at the NEC, Birmingham, from Tuesday April 28 to Thursday April 30, 2020.

Doors open at 08.30 each day, and the CV Show runs until 17.00 on the Tuesday and Wednesday, and 16.30 on the Thursday.

CMS has attended the Commercial Vehicle Show over the last few years with partner organisations in the insurance and telematics sectors.

For the Commercial Vehicle Show 2020, we took the decision to exhibit at the CV Show, by ourselves, to showcase our industry leading risk management solutions.

These unlock the power of connected data, making risk management simple and more effective than ever before.

This gives insurers, fleets and remote worker organisations the right information to take fast decisive actions that reduce employee risk, and ultimately help them manage risk better, making the working world safer.

Our founder and CEO, Charles Smith will be at the CV show.

Charles has been championing the power of using connected data to better manage risk since founding CMS in 2012.

He is known in the commercial vehicle industry for his knowledge and insight relating to employee and driver risk management as applied to large fleets, commercial insurers and technology manufacturers.

In addition, our Head of Product, Colin Woolmer and Head of Customer Operations, Helen Wilson will be at the CV Show, plus other members of team CMS.

Please take the time to visit the stand to find out first-hand how we can help your organisation make better use of its connected data and manage risk better.

CMS will be in Hall 4 of the CV Show, on stand 4G60. We’ll be listed as Collision Management Systems in the show guide.

Please feel free to visit our stand (4G60) at any time over the three days of the CV Show.

Team CMS will be more than happy to take you through our solutions and help you discover how they can help your organisation with its connected data and risk management.

However, if you’d like to set up a dedicated meeting with Charles and the team, please let us know; call 0345 241 9449 or email info@18.133.239.125

That way we can allocate Charles’ time for you and help make your visit to the CV Show as effective as possible.

All of us in Team CMS are looking forward to meeting you at the Commercial Vehicle Show 2020 and watch this space for more information as we build up to the show at the end of April.

Useful links: