CMS’ Risk Management Platform now easily available to UK Public Sector, via CCS Telematics framework

We mentioned a few posts back that CMS was accepted on to the new Crown Commercial Services (CCS) telematics framework.

That is, CCS telematics framework RM6143, in partnership with NTT DATA UK.

It replaces CCS telematics framework RM3754.

Two Lots are included within the new framework.

Lot 1 covers the supply of vehicle telematics hardware, software and associated products.

This includes products such as cameras and tracking solutions for equipment fixed or stored within a vehicle.

Lot 2 is restricted to only ten suppliers, and CMS is listed as one of them, under NTT DATA UK Limited , our partner

RM6143, CCS telematics framework, Lot 2: Supply of fleet data analysis and risk management solutions

“Suppliers on this Lot will provide a software platform designed to enable buyers to analyse data from multiple sources to support their fleet operation, optimise fleet whole life costs and undertake effective risk management activities.”

Expires: 23/04/2024

RM6143 CCS telematics framework is live

Well, the framework is now live, as of May 1 2020.

Meaning that public sector fleets can more easily and more simply access our telematics data aggregation and risk management platform.

This includes fleets such as central government as well as the wider public sector including local authorities, the NHS and the emergency services.

It does this by eliminating the need to go to tender.

CCS telematics framework RM6143, speeds up the procurement process. Thereby saving time and delivering the benefits of our telematics data aggregation and risk management platform, faster.

How does this help Public Sector fleet managers?

CMS’ all in one platform helps fleet managers. Both in the public and private sectors. Improve the safety of their drivers, through effective risk management insight.

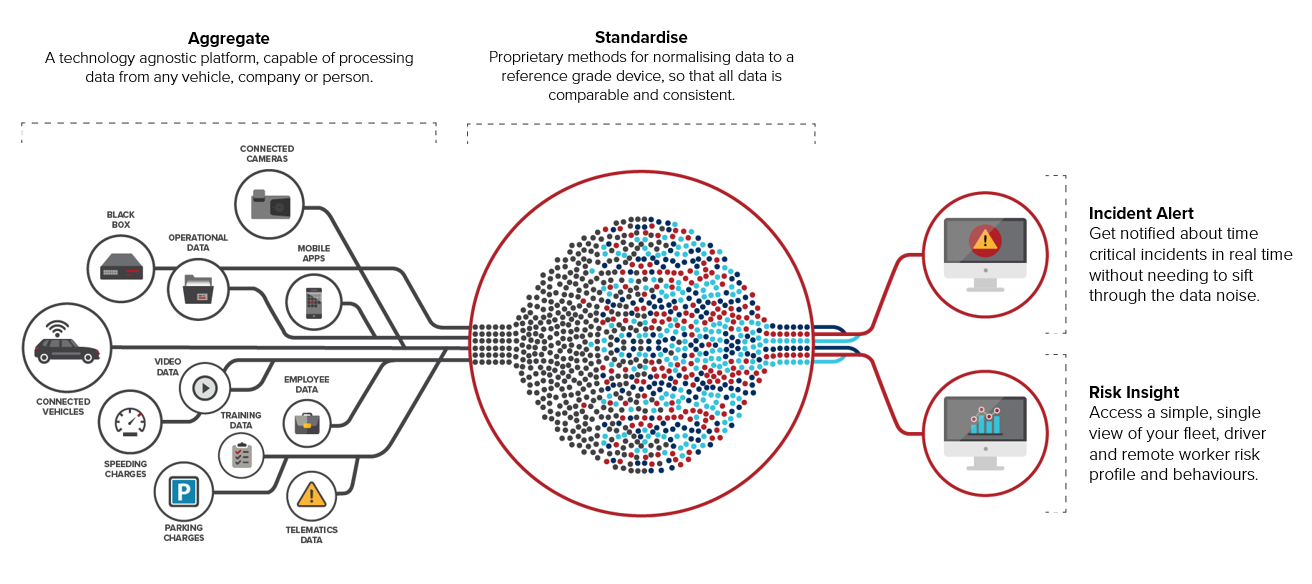

It does this by aggregating and standardising their existing data feeds. That’s the telematics data aggregation side of our work.

Which means that, it provides the right information at the right time.

With this fleet managers can take fast decisive actions to reduce employee risk and deliver cost savings.

With no-need for any additional hardware. In a future proofed, hardware agnostic way.

The platform combines the operator’s existing telematics and in-vehicle camera feeds with non-vehicle driver data. To present a user-friendly risk management and real-time incident alert solution.

What does our risk management platform do?

On a day to day basis, the platform alerts fleet managers, in real time, to the incidents that need their attention.

It does this by filtering out distractions from false positives, and eliminating the problem of too much data from telematics.

Over the short to medium term it allows fleet managers and those responsible for risk management in the organisation, to know in more detail, their driver’s risk profiles.

From this, they will also know the organisation’s overall vehicle operations risk profile.

And with this insight, they can manage the trends, to reduce fleet & driver risk in their organisation.

That is, it works to help stop incidents happening in the first place and to keep people safe.

What did Charles Smith, CEO at CMS, say about the news?

Charles Smith, founder and CEO at CMS commented;

“We are thrilled that CMS has been awarded one of just ten places on the new Crown Commercial Services Vehicles telematics framework. In conjunction with our partner NTT DATA UK. Through this we can deliver risk management and safety solutions to any public sector body directly. Under a pre-approved contract and framework.”

Get in touch to find out more

We have helped fleets and insurers manage their data in the most efficient ways possible.

By collecting their existing telematics data, camera footage and HR related data, direct from all their sources. Then aggregating it, standardising it and displaying it all in one system.

They have all seen a massive ROI in the first year.

If this sounds of interest please call us on +44 (0)345 241 9449, email us at info@18.133.239.125 or fill in the contact form here